1:2000 Leverage

ThinkMarkets is a popular multi-regulated broker that provides access to trade Forex and CFD instruments, good trading solutions, and a technology infrastructure.

ThinkMarkets

ThinkMarkets is a trustworthy broker offering trading in forex and CFDs. Users can choose between MT4 and MT5, plus the broker’s ThinkTrader platform. This, along with low trading fees and over 4000 instruments makes the ThinkMarkets group an attractive proposition. Our review will unpack the login process, client portal features, and more.

ThinkMarkets was founded in 2010. The group has headquarters in Melbourne and London and forms part of Think Capital Limited, a company registered in Bermuda.

Is ThinkMarkets Regulated? Legit? Safe?

The regulatory status ensures that the customers are fairly treated according to international laws and norms, and their funds are safe in Banks like Barclays, National Australia Bank, and the Commonwealth Bank of Australia, as Broker mentions on its site. In addition to that there are numerous ways how Broker protects clients and establish safe trading environment

- TF Global Markets Limited – authorized by FCA (UK) registration no. 629628

- TF Global Markets Pty Ltd – authorized by ASIC (Australia) registration no. 424700 ABN: 69158361561

- TF Global Markets (Aust) Ltd – authorized by FMA (New Zealand) registration no. FSP623289

- TF Global Markets (Europe) Ltd – authorized by CySEC (Cyprus) registration no. 321503

- TF Global Markets (Pty) Ltd – authorized by FSCA (SA) registration FSP No 49835

- TF Global Markets Int Limited – authorized by FSA (Seychelles) registration no. 8424818-1

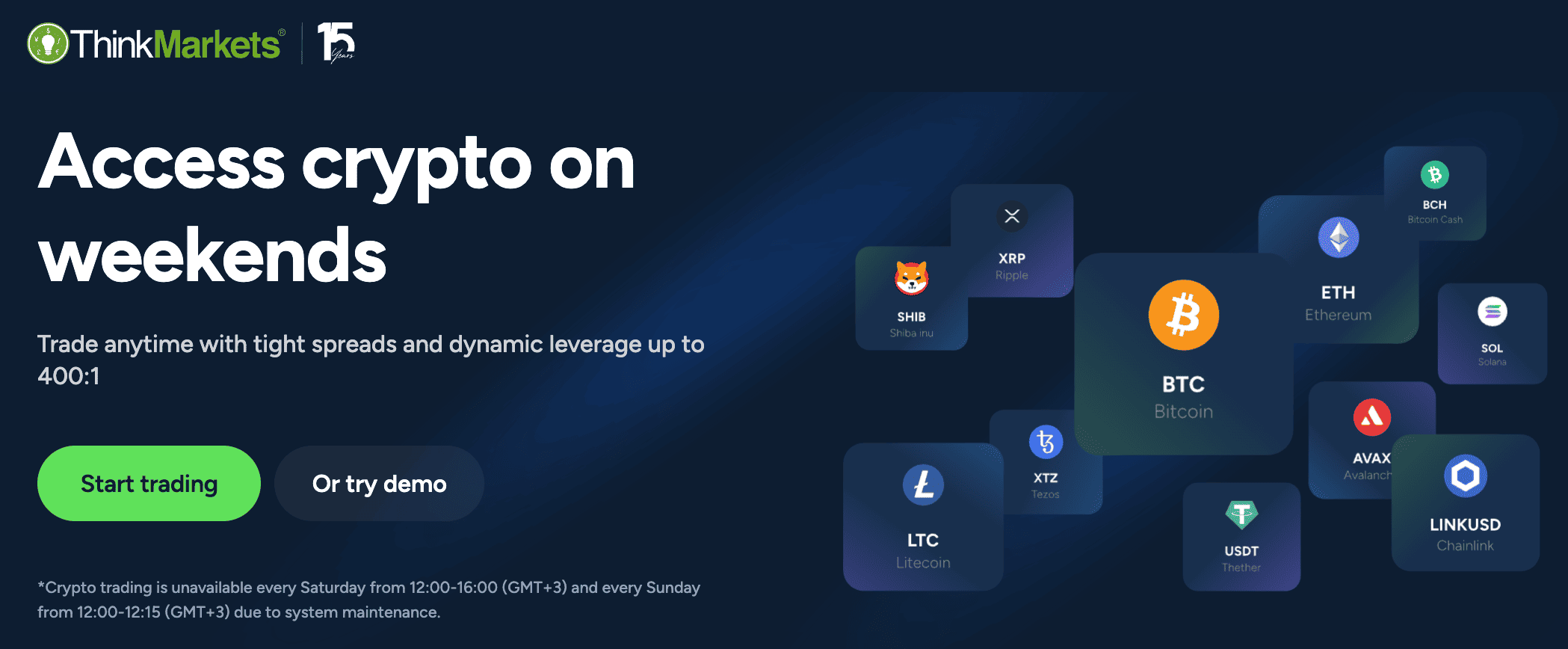

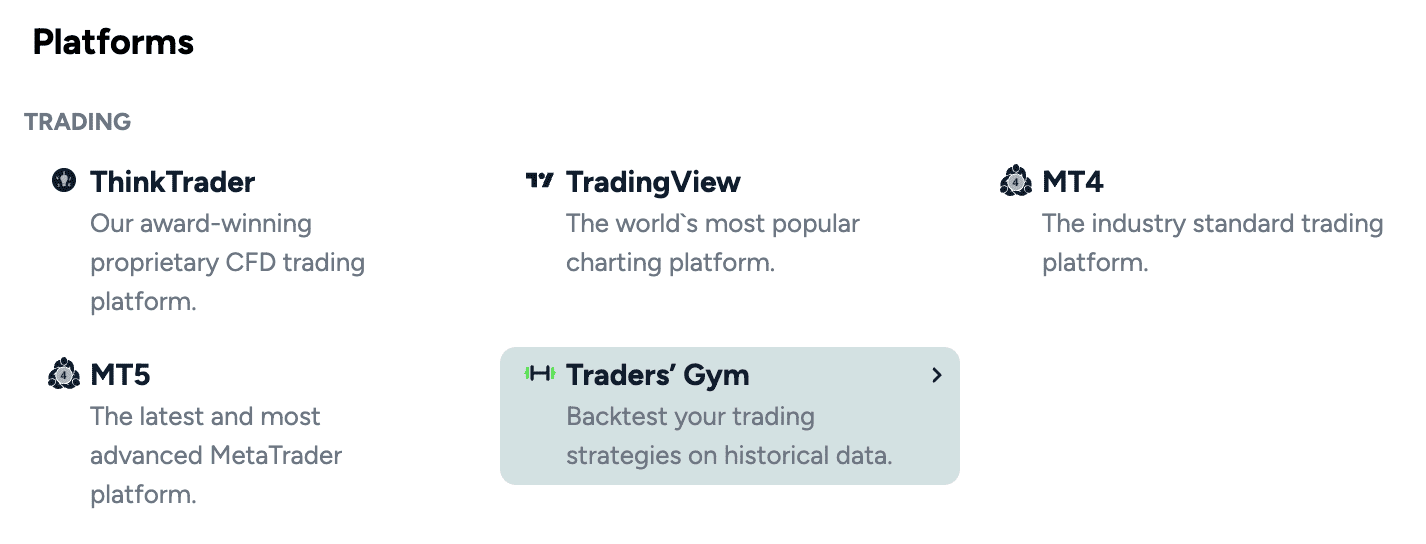

What platforms does ThinkMarkets offer?

Three trading platforms are available; the broker’s own ThinkTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

Platforms:

- MT4: Mobile (Android, iOS, iPad), MT4 Web, MT4 Desktop download for Windows and Mac.

- MT5: Mobile (Android, iOS, iPad), MT5 Web, MT5 Desktop download for Windows.

- ThinkTrader: Mobile, Tablet, Desktop, ThinkTrader Web.

- TradingView: Mobile, Web.

What are the AvaTrade account types?

As with almost all top brokers in the industry, AvaTrade makes several great account type choices available to meet your needs as a trader.

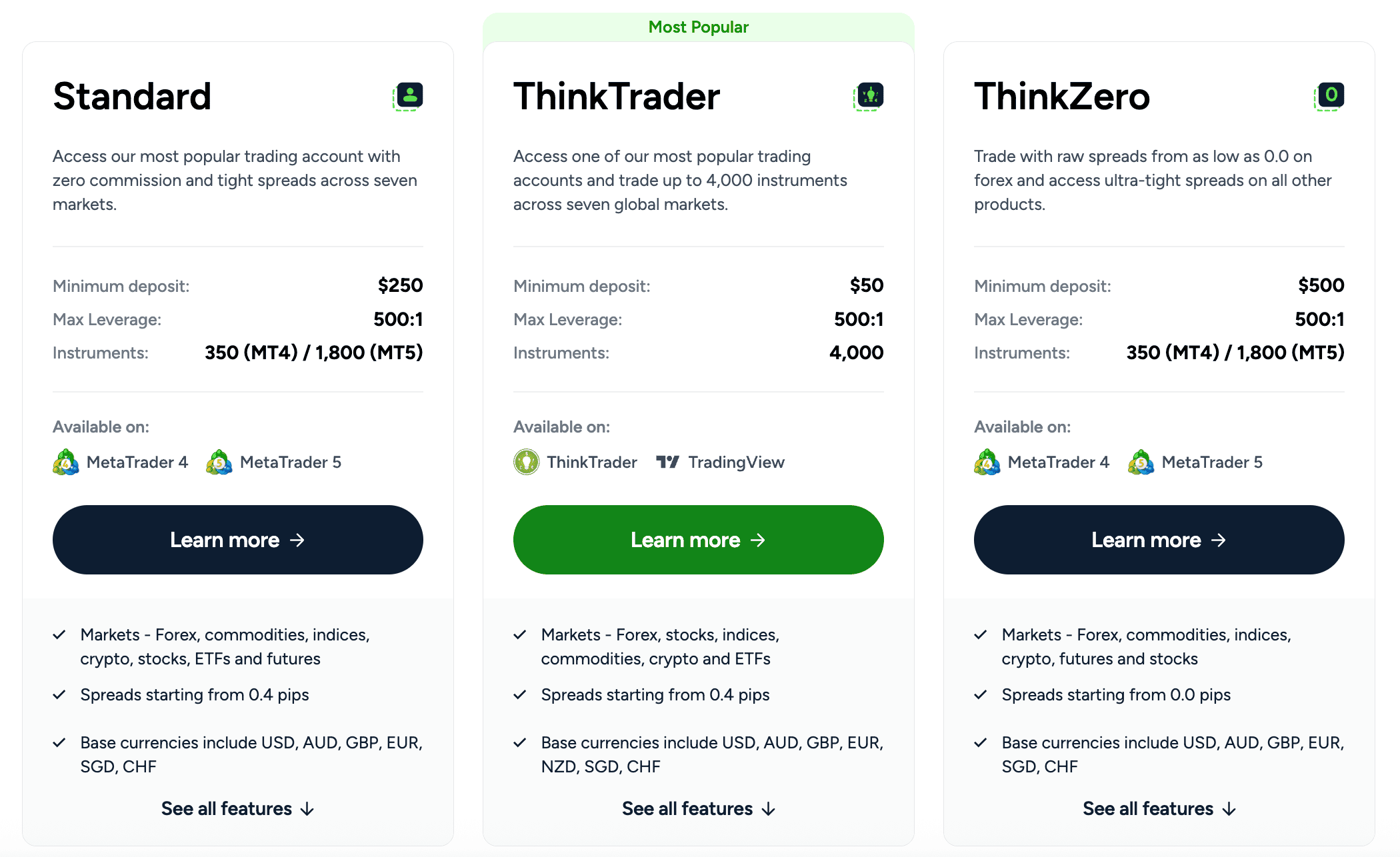

Standard Account

The standard account is ThinkMarkets’ most demanded trading account with zero commission and tight spreads starting just from 0.4 pips across seven markets, including Forex, commodities, indices, crypto, stocks, ETFs, and futures. The account types are available on the MT4 and MT5 platforms, while the minimum deposit for the Standard account is $250. On the MT4 platform traders can access 350 instruments, while the MT5 platform enables access to over 1,800 instruments so is important to note the differences too. The Standard accounts enable EA trading, and also, provide Negative Balance Protection, 100% margin call, and 50% Margin Callout.

ThinkTrader Account

ThinkMarkets’ ThinkTrader account type stand out for its different conditions from the Standard accounts, as the main difference is that the trades with this account type are conducted only on the ThinkTrader and Trading View platforms, through which clients can access over 4000 instruments, so much larger range if compared to Standard account. There is no commission, and the spreads are good starting from 0.4 pips, the initial deposit is lower than for the Standard accounts, starting at $50, and the Multiplier is up to 1:500. The ThinkTrader accounts do not support EA trading or Copy Trading.

ThinkZero Account

With these account type the main difference is Fee basis, Unlike the Standard and ThinkTrade accounts, ThinkZero with raw spreads from 0.0 pips on forex and for the other instruments are provided ultra-tight spreads, and apply a $3.50 commission per side, thus those traders who favor spreads-based trading, the ThinkZero account might not meet their trading needs but choose Standard account. Traders can access ThinkZero through the MT4/MT5 platforms and gain access to 350 instruments on the MT4, and 1,800 on the MT5 platform, EA trading, and VPS. To fund the ThinkZero accounts clients need to make at least $500 initial deposits. The accounts are ideal for high-volume traders, scalpers, and those who want to use Expert Advisors (EAs) to automate their trading.

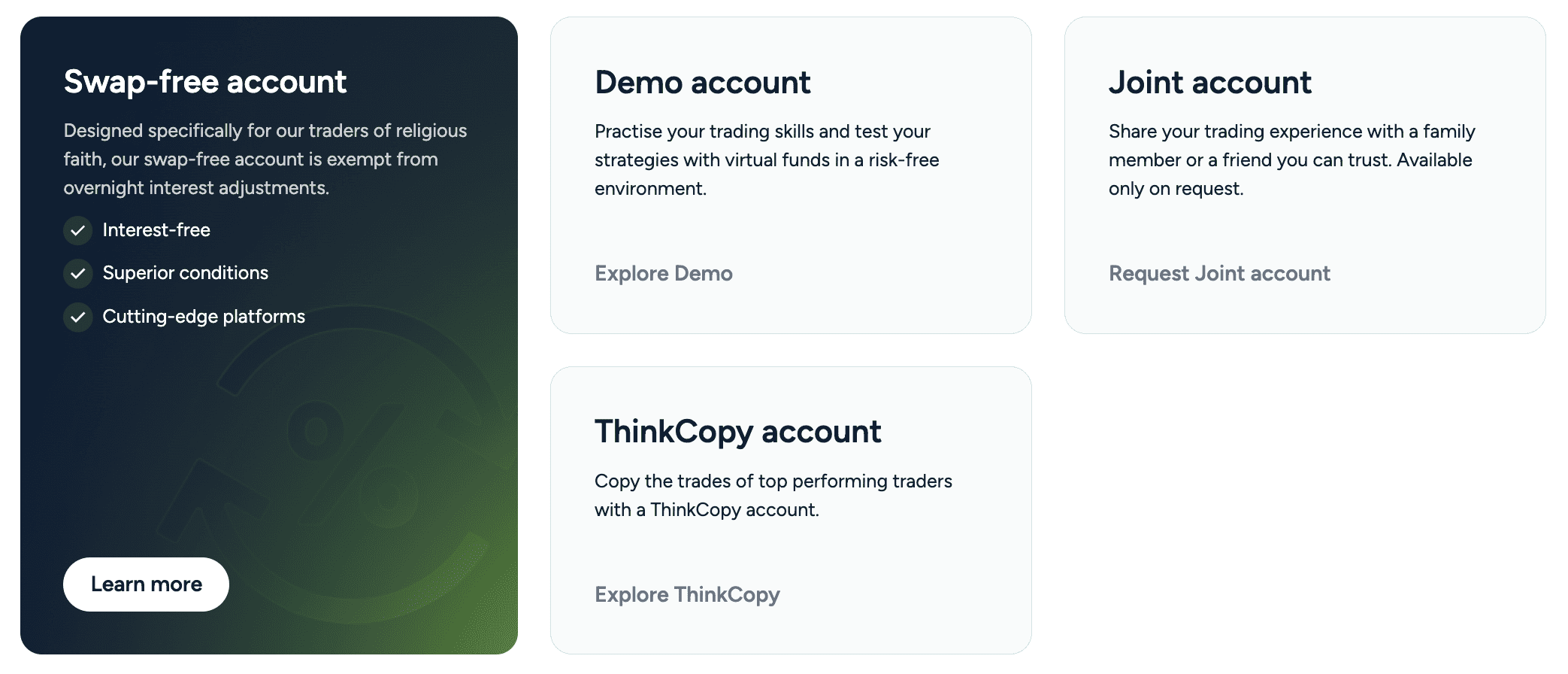

Swap-free Accounts

As a professional trader you also have the chance to trade through the AvaTrade professional account offering. If you want to open a professional account though you should note that you will have to meet at least two of the following requirements:

All ThinkMarkets account types can be converted to swap-free accounts with no additional fee. This means that the minimum deposit and other conditions depend on the account type traders have requested a swap-free account. The swap-free accounts enable traders to trade without incurring any swap fees, known as “overnight fees”, for positions kept open at the end of each trading day.

ThinkMarkets spreads and commissions

ThinkMarkets scored highly in terms of trading fees. Spreads are variable and start from zero pips on major FX pairs, such as the EUR/USD and GBP/USD.

With the ThinkZero spread account, there is a $3.5 commission per side of 100,000 (£2.5 units per side in the UK). This commission applies to FX and Metals only and ThinkZero accounts are available on MetaTrader 4 and MetaTrader 5 platforms.

ThinkMarkets reserve the right to charge an inactivity fee.

Traders will be pleased to see there are no swap rates.

What is the ThinkMarkets minimum deposit?

Thinkmarkets offers a minimum investment entry of just $50.

What are the ThinkMarkets deposit and withdrawal methods?

Funding your account is available via several deposit methods (which may vary depending on the client’s country of residence and the ThinkMarkets entity):

- Google Pay & Apple Pay – available currencies: USD, EUR, GBP, AUD. Estimated processing time: up to 10 minutes

- Bank transfer – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: 1 – 3 business days

- Credit & debit card – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: instant

- Skrill – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: up to 10 minutes

- Neteller – available currencies: AUD, GBP, USD, JPY, EUR. Estimated processing time: up to 10 minutes

- Bitpay – available currencies: Bitcoin, Ethereum and Bitcoin Cash. Estimated processing time: up to 10 minutes

There may be more deposit methods available depending on your local area. The best place to check these out is the deposit area of your ThinkMarkets account.

Are there bonuses or promotional offers on ThinkMarkets?

ThinkMarkets introduced loyalty points for new clients; exclusive rewards programme.

When you open a ThinkMarkets live account and your application is approved, you’ll receive 125 loyalty points — giving you a head start from day one.

How to claim your points:

- Sign up for a ThinkMarkets live account

- Submit copies of your ID and proof of address

- Once your account is approved, we’ll credit 125 points within 24 hours

With ThinkRewards, you earn points on every trade, which can be redeemed for trading credit or cash — no restrictions. The welcome bonus helps you move up the status tiers faster and unlock even more rewards.

In Which Countries is ThinkMarkets not Available?

Due to Regulatory restrictions, ThinkMarkets does not provide its services to the residents of the following countries:

- Japan

- The United States

- Canada

- Bermuda the European Union

- Australia

- The United Kingdom

- Russia