1:1000 Leverage

XM is a good broker for many types of traders thanks to its flexibility and range of features. Beginners will find XM particularly appealing due to its unlimited demo account, a minimal minimum deposit requirement of just $5, and an exceptional educational section that is among the best in the industry.

XM Forex

XM is an online brokerage firm founded in 2009 in Belize, and is part of Trading Point Holdings Ltd. Other than XM, Trading Point Holdings Ltd. owns two other brands, which are Trading.com and Trading Point Asset Management. XM specializes in providing CFD (Contract For Difference) trading across various markets such as forex, commodities, indices, cryptocurrencies, and stocks.

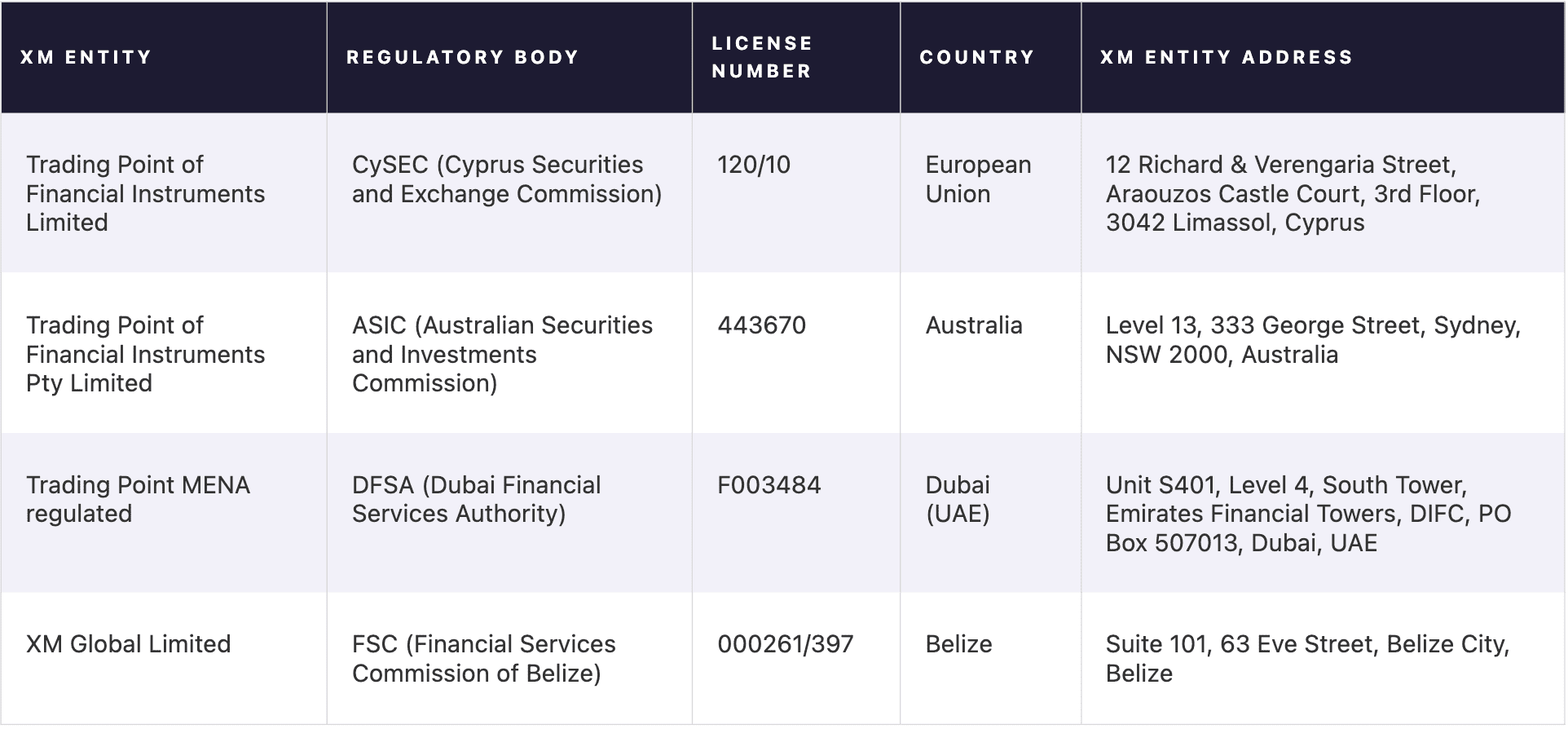

Is XM Regulated? Legit? Safe?

Yes, XM is regulated by CySEC (120/10), ASIC (443670), DFSA (F003484), FSC (000261/397). Since XM is CySEC regulated, it is also ESMA compliant and it can operate all across the European Union.

The XM entities and their relative licence released by each regulatory body can be found below:

XM was established in 2009 and is known to be a trustworthy broker, serving over 10,000,000 clients globally and employing 900 professionals.

The XM headquarter is located in Suite 101, 63 Eve Street, Belize City, Belize. As of today, XM also has offices in Cyprus (Limassol), Australia (Sydney), and the UAE (Dubai).

XM has won over 70 industry awards. The most recent XM awards include:

- Most Transparent Broker in the world 2023 (CFI.co)

- Most Reliable Broker in the world 2023 (CFI.co)

- Best FX Customer Service 2023 (World Finance Forex Awards)

How does XM protect clients’ money?

XM protects its clients’ funds through the use of segregated bank accounts, which keeps client money separate from the company’s own funds.

Furthermore, XM provides an Investor Compensation Fund (ICF), which offers compensation of up to €20,000. This fund acts like an insurance for traders, offering protection in the event of XM’s bankruptcy or in disputes between the trader and XM.

In addition to these measures, XM also offers Negative Balance Protection for traders. This feature ensures that traders will not lose more money than they have deposited.

What platforms does XM offer?

The XM trading platforms available are listed below:

- MetaTrader 4 (MT4), available as webtrader, desktop and mobile

- MetaTrader 5 (MT5), available as webtrader, desktop and mobile

- XM trading platform, available as webtrader

The platforms available at XM provide stop losses, take profit, limit orders, and trailing stops. There are also basic trading indicators like the Stochastic Oscillator along with other tools to facilitate both technical and fundamental analysis.

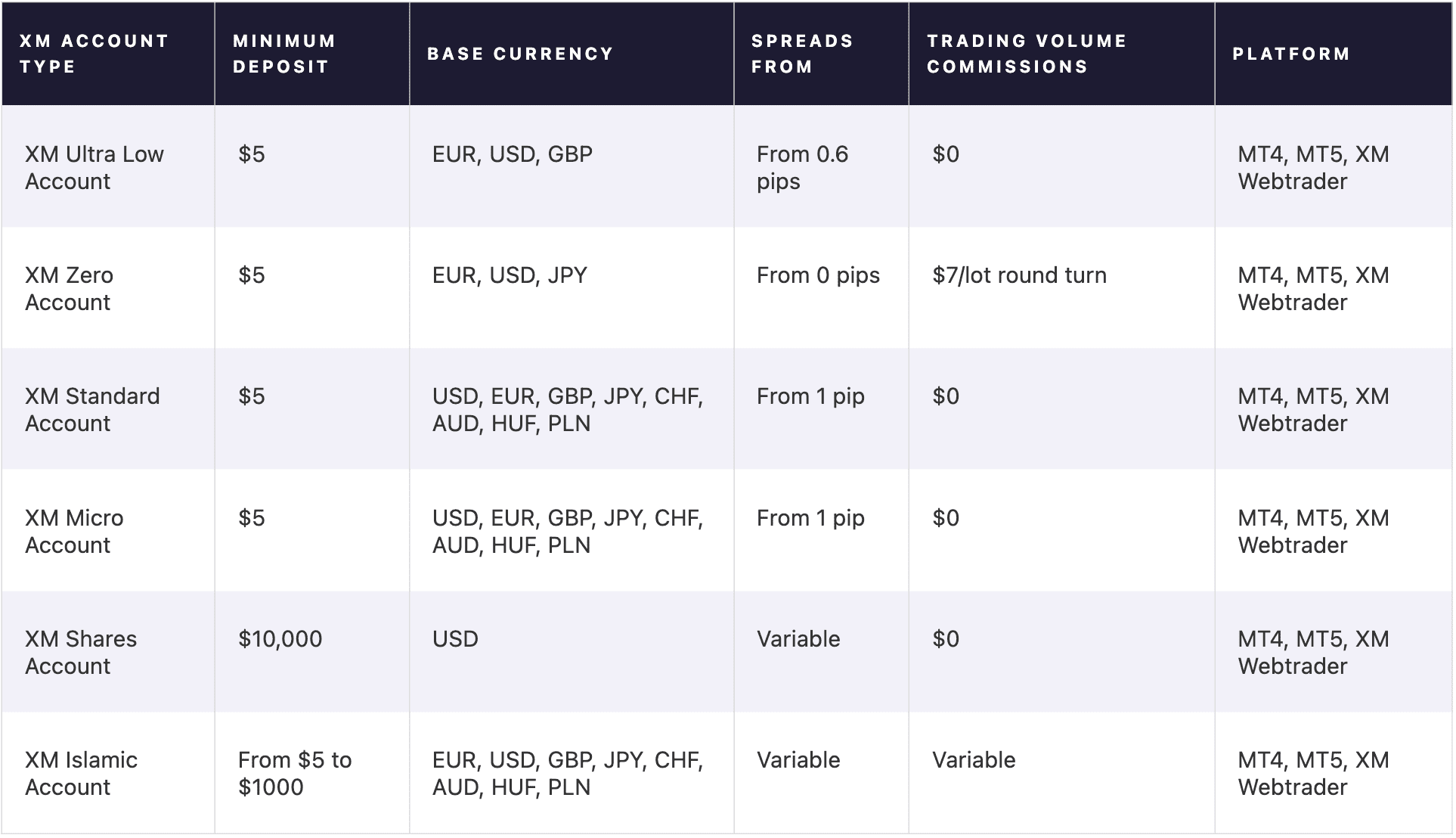

What are the XM account types?

XM offers a very wide range of accounts. The XM account types can be found below.

For whom are account types suitable?

- XM standard account: Best for day traders

- XM micro account: Best for beginners

- XM zero account: Best for scalpers

- XM ultra-low account: Best for scalpers

- XM shares account: Best for real traders

- XM Islamic account: best for Muslim traders

XM Copy Trading – Try Now

What are the fees on XM?

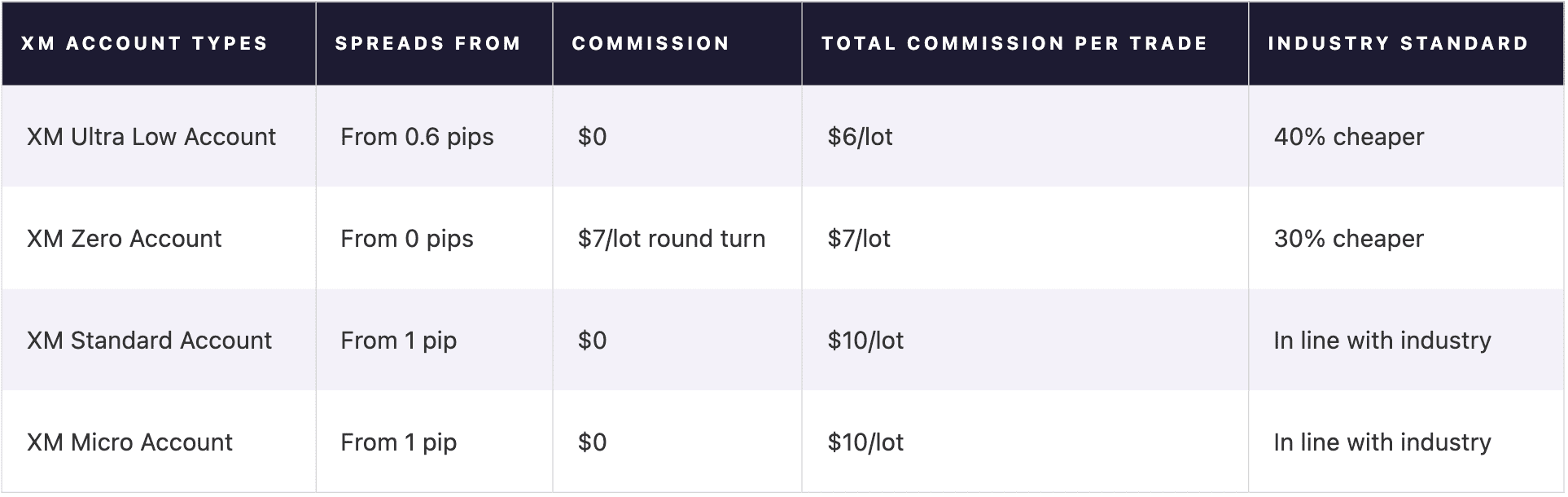

The fees and commissions charged by XM are listed below:

- Spreads: When the mark-up is applied, spreads start from 0,6 pips, except on the standard and micro account where spreads start from 1 pip.

- Volume-based commissions: When the spread mark-up isn’t applied, such as on the XM Zero account, there’s a volume-based commission from $7/lot round turn.

- Overnight fees: XM charges an overnight fee (but not on the XM Islamic account).

- Dividend withholding: XM implements a varying withholding tax on dividends contingent on the specific stock. For US stocks, na 30% tax is applicable on dividends.

- Inactivity fee: XM imposes a $10 inactivity fee on real trading accounts that have not engaged in any trading activity for 90 days or more.

XM trading spreads and commissions

The XM average cost per trade is $8,25, calculated as an average across all XM account types (17,50% lower than the average cost per trade industry standard), considering a 1 lot volume trade on the EUR/USD Forex pair.

The cheapest account on paper at XM is the XM Ultra Low account which charges spreads from 0.6 pips (40% cheaper than the industry standard), however, you should keep in mind that the average spread may be higher than that.

Another alternative is the XM Zero account, which charges raw spreads from 0 pips and a fixed commission of $7/lot round-turn, which is in line with the industry if compared to other raw accounts.

The other account types at XM (XM Standard and XM Micro) charge spreads from 1 pip, which are in line with the industry standard of 1 pip.

What is the XM minimum deposit?

The minimum deposit at XM is $5 for all account types, except from the XM Shares account which is $10,000.

XM deposits are fee-free as the broker covers 100% of them. The only exception is for wire transfers, where XM covers deposit fees only for transactions over $200.

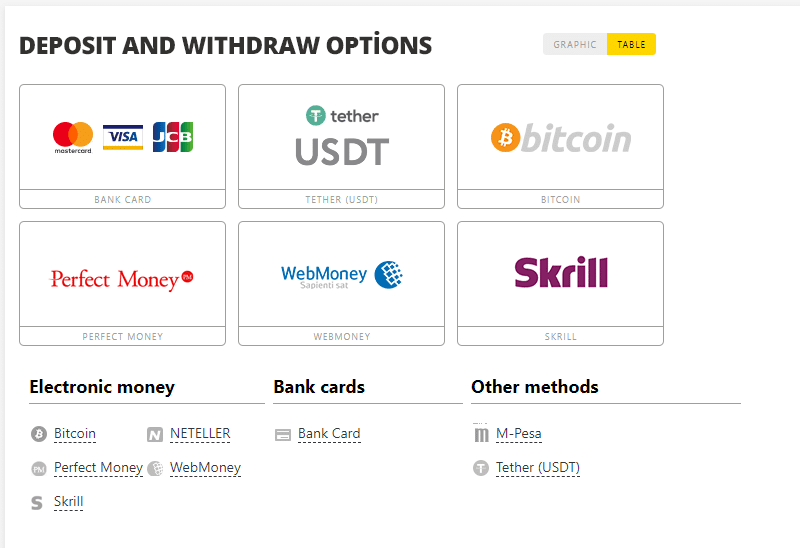

At XM you can use different payment methods like Wire transfers, Credit cards, Debit cards and eWallets.

What are the XM deposit and withdrawal methods?

XM allows traders to deposit and withdraw money through wire transfer, credit and debit cards and eWallets such as Neteller and Skrill and Crypto.

The full list of XM deposit and withdrawal methods can be found below:

Keep in mind though, that some of these payment methods may be not be available in some regions.

It’s important to remember that the XM withdrawal method must correspond to the method used for deposits. This means if you deposit funds via wire transfer, your withdrawals will be processed back to the same bank account used for the deposit.

Additionally, XM does not impose a minimum amount for withdrawals, and do not charge fees.

Are there bonuses or promotional offers on XM?

The XM bonuses ans promotional offers can be found below:

- $30 No Deposit Bonus: XM provides a $30 bonus without any deposit required, exclusively for new clients. Profits made using this bonus can be withdrawn, but not the bonus itself.

- XM Bonus Program: XM’s bonus program gives a 50% bonus on deposits up to $500 and a 20% bonus on deposits up to $4,500, applicable to all deposits over $5. Only profits from the bonus can be withdrawn.

- XM Competitions: XM organizes competitions where traders can win cash prizes, bonuses, or items, and even become a Strategy Manager. These competitions, open for both Real and Demo accounts, provide an opportunity to test skills, gain insights, and compete with peers. Traders can enter competitions that match their profile, with detailed information and rankings available.

- VPS: request the VPS for a 28 USD monthly fee, which will be automatically deducted from your MT4/MT5 account on the first day of each calendar month.

- XM Loyalty Program: XM offers a loyalty program where traders earn points for each lot traded. These points can be redeemed as rebates or used for special bonuses, including seasonal offers, a 50% and 20% deposit bonus, and a $50 trading bonus.

What assets can you trade on XM?

At XM you can trade CFD assets on forex, commodities, indices, cryptocurrencies and stocks. Additionally, you can trade around 100 stocks as real at XM.

Is XM good for scalping?

Yes, XM is good for scalping.

The availability of accounts like the XM Zero Account, with raw spreads starting from 0 pips is particularly advantageous for this trading technique. However, it’s important to note that there’s a volume-based commission of $7/lot round turn on this account, which is in line with the industry average.

In Which Countries is XM not Available?

XM is not available in Canada, USA, Iran, Israel and Japan.

Final Thoughts:

The key features and main characteristics of XM are listed below:

- Competitive pricing: XM requires a very low minimum deposit from just $5. Spreads mark-up start from 0,6 pips, while forex commissions charged on raw spreads (on the Zero account) start from $7/lot round turn.

- Variety of account types: XM offers 8 account types in total, which include accounts for every need. There’s a demo account, low spread accounts, raw spread accounts, as well as islamic accounts.

- Swap free account: The Islamic account at XM is one of the best worldwide, as it doesn’t charge additional fees to compensate for the lack of swap fees.

- Great market research tools: other than standard market analysis tools (such as the economic calendar), XM provides podcasts and live videos providing traders with insights and updates on the market trends.

- Great educational tools: XM provides both a live education platform and education rooms where traders can watch live interviews and daily shows to enhance their trading skills.

Low - Variable

Low - Variable