1:10000 Leverage

FxPro is an NDD broker, meaning that it is the counterpart between the broker and the market. As a large volume trader you will have a VIP account with competitive spreads, low-commissions, and a free VPS. Several top platforms are provided by this broker who has won 70 awards over the years and offer both fixed and floating spreads.

FxPro

FxPro is a hugely experienced broker and industry stalwart. The broker was founded in 2006 in the UK and now operates worldwide. Since launching, FxPro has collected more than 70 industry awards and also has respected regulation in place from the FCA, CySEC, FSCA, and SCB.

Is FxPro Regulated? Legit? Safe?

Like any other broker platform, FxPro is a network of companies that answers to different regulatory bodies that allow them to operate worldwide.

4 industry regulations: FxPro is well-known throughout the industry as a trustworthy and reliable broker. The platform is regulated by the FCA, CySEC, FSCA and SCB.

In the UK, FxPro UK Limited is regulated by the Financial Conduct Authority to provide CFDs under the authorization FCA No. 509956. That being said, the company operates affiliates that answer to other Tier 1 regulatory bodies as follows.

- FxPro Financial Services LTD (CYSEC 078/07) to operate within Cyprus.

- FxPro Financial Services LTD is also authorized by FSCA to operate within South Africa (FSCA 45052).

- FxPro Global Markets LTD in Bahamas (SCB Bahamas SIA-F184).

All those companies are regulated and work as a whole body to provide users with one of the widest selections of assets.

What platforms does FxPro offer?

A good platform is the best tool to enhance traders’ performance. Besides excellent knowledge, having the right trading station is critical to developing all that you have learned.

One of the advantages of trading with FxPro, is the variety of platforms and account types that we offer. Not only do we provide a range of top-grade trading platforms, like cTrader, Metatrader 4, Metatrader 5 & proprietary solution, but we also offer different trading conditions, allowing for a more personalised experience, tailored to your specific preferences.

With more than 2100+ CFD assets in 6 different classes, quality execution, advanced online trading tools, and trading systems, we have got something that will meet everyone’s demands!

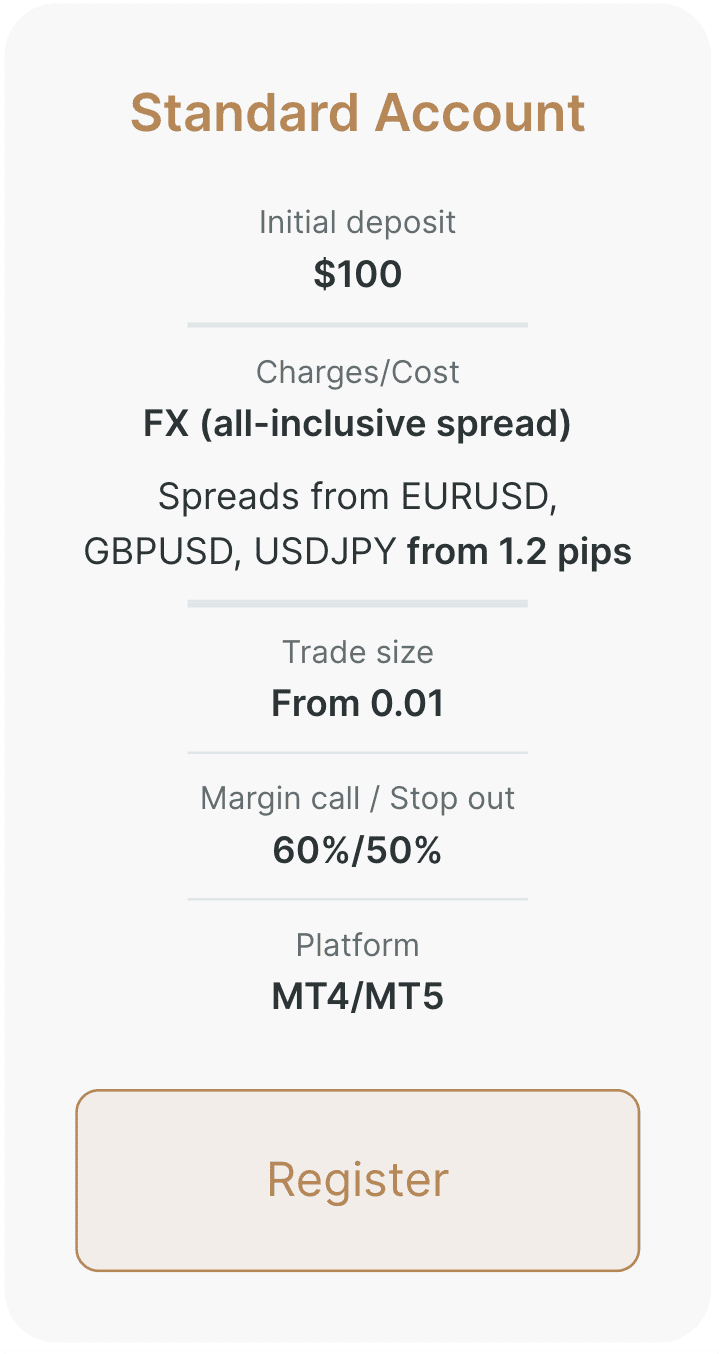

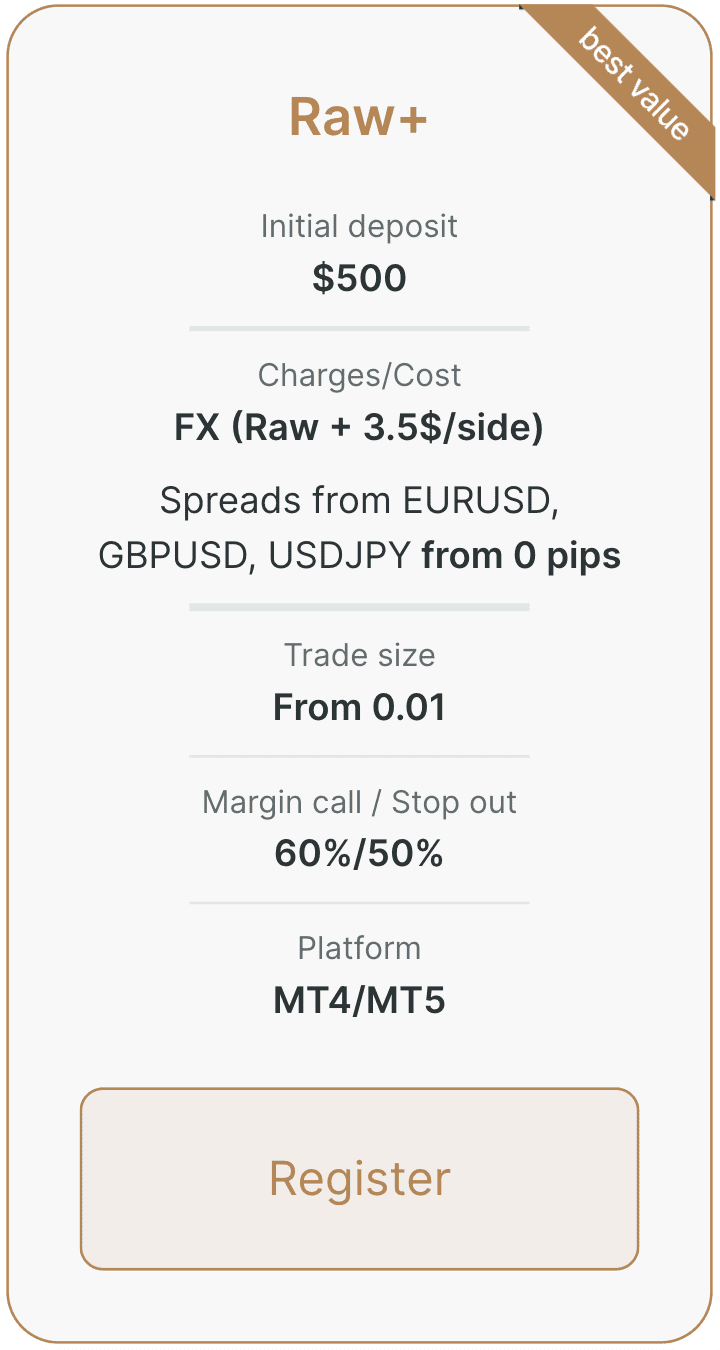

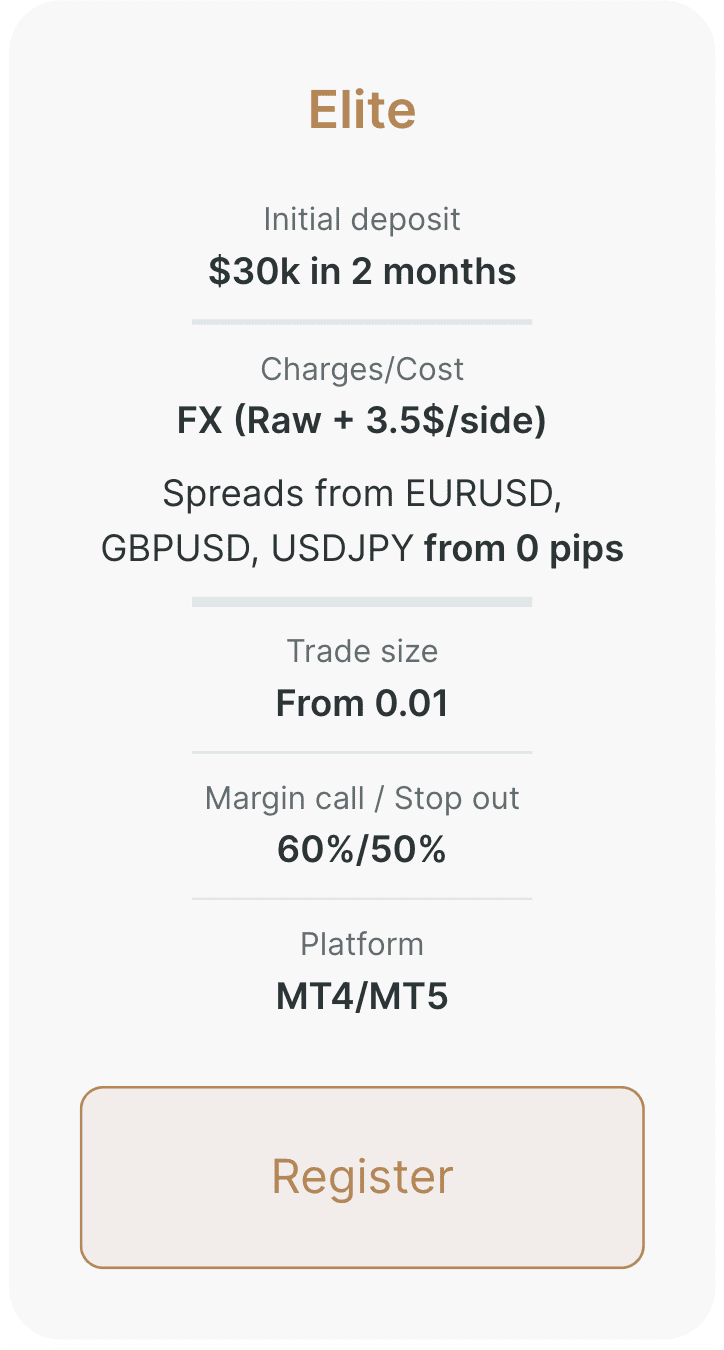

What are the FxPro account types?

Our research team identified eight major types of accounts in the FxPro platform that range from novice traders with a small amount of money to invest to professional investors with hundreds of thousands of dollars, yens, or euros or even pesos.

With these several options to choose from, the variety of platforms are vast and one should fit most of your trading needs. Not many brokers offer this array of platform selection so ensure you take the time to find the one that fits best for you.

FxPro trading spreads and commissions

As far as Spreads & Commissions go, the spreads with FxPro differ depending on the account you have chosen, the market hour, the execution, and on the platform.

Floating spreads: There are a number of different types of spreads, a spread being where the broker makes money and the difference between ask and bid. For instance, the FxPro account attracts a floating spread for market and instant execution. MetaTrader Accounts spreads on forex start from 1 pip. For cTrader accounts spreads start from 0 pips although a commission of $9/lot is applied to round turn trading.

Fixed Spreads: For fixed spreads, where the spread stays the same no matter what size you trade, these are made available only on MT4 for forex trading and will depend on the time of day and volatility of the markets. Typically, spreads are lower during the most popular market hours. These are increased outside these hours or they can widen during highly volatile trading to enable you to get your fill. The fixed spreads are offered with the FxPro Instant Execution.

Here are the FxPro spreads on some of the most traded assets:

- EUR/USD – 0.1 pips (1.6 fixed).

- Gold – 0.25 pips.

- S&P 500 – 0.700 pips.

- Bitcoin – $10/unit.

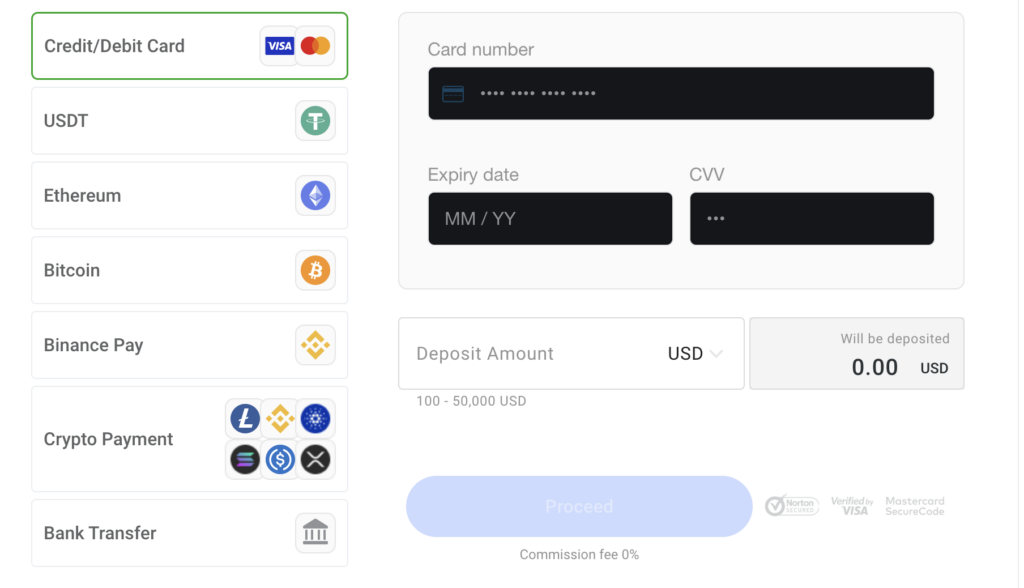

What is the FxPro minimum deposit?

FxPro minimum deposit is $100 or equivalent depending on the currency you deposit with. Deposits generally take 10 minutes, but the first deposit may take longer.

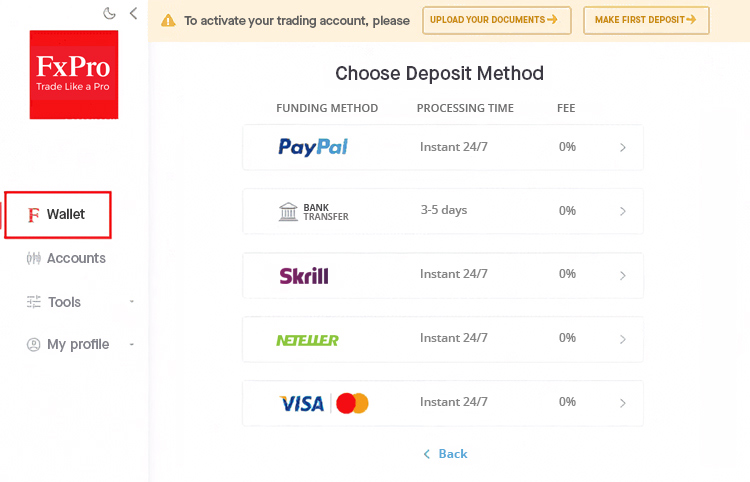

What are the FxPro deposit and withdrawal methods?

There are a number of ways in which you can deposit&withdraw and generally all are free-fee. The availability of e-wallets (Neteller & Skrill) depends on your country of residence. In addition, crypto deposits and withdrawals are possible as of 2025.

Are there bonuses or promotional offers on FxPro?

Unfortunately, FxPro does not offer a bonus to its customers.

What assets can you trade on FxPro?

There are more than 260 assets in total and this includes forex, futures, indices, shares, metals, and energies. You will find a competitive spread with the averages starting low as follows on some of the most traded assets: 0.31 pips EURUSD, 0.7 pips GBPUSD, 0.92 pips EURGBP, 0.62 pips Gold. This is on the level with most other brokers if not better. Fixed spreads are also offered through MT4 if you are trading forex pairs.

Is FxPro good for scalping?

FxPro a strong choice for experienced day traders, scalpers and algo traders.

In Which Countries is FxPro not Available?

FxPro provides services to most of the countries in the world. However, the broker has some relevant exceptions like Tunusia, Canada, United States, Iran, Iraq and Myanmar.