1:500 Leverage

Established in 2009, Vantage Markets is a globally recognized forex and CFD broker headquartered in Sydney, Australia. With over 15 years in the industry, the broker serves more than 5 million clients worldwide, offering a range of trading instruments and platforms.

Vantage Markets

One of the leading online brokers based in Australia, Vantage FX offers a range of trading services, enabling clients to access the international Forex market. Benefiting from award-winning customer care and with a commitment to delivering fast transactions, VantageFX is a significant player in the online broker arena.

Vantage Markets Overview

Founded in 2009 and headquartered in Sydney, Australia, Vantage Markets has steadily positioned itself as one of the globally trusted names in forex and CFD trading. With over 15 years of operational experience, the broker now serves more than 5 million clients from across the world — a testament to its sustained growth and industry relevance. Vantage offers a broad spectrum of trading instruments including forex pairs, commodities, indices, shares, and cryptocurrencies, catering to both novice traders and seasoned professionals.

Licensing & Regulation – Is Vantage Reliable?

Vantage Markets operates under the supervision of multiple reputable financial authorities, ensuring a strong legal framework and robust client protection. These include:

- Australian Securities and Investments Commission (ASIC) – License No. 428901

- Financial Conduct Authority (FCA), United Kingdom – License No. 590299

- Vanuatu Financial Services Commission (VFSC) – License No. 700271

- Financial Sector Conduct Authority (FSCA), South Africa – License No. 51268

- Cayman Islands Monetary Authority (CIMA) – License No. 1383491

It’s essential to recognize that regulatory protections vary. Clients under the FCA, for example, are eligible for coverage through the UK’s Financial Services Compensation Scheme (FSCS), while those under offshore entities like VFSC or CIMA may have limited investor protection. Vantage’s transparent regulatory framework allows clients to select the level of oversight that matches their risk appetite and jurisdictional preferences.

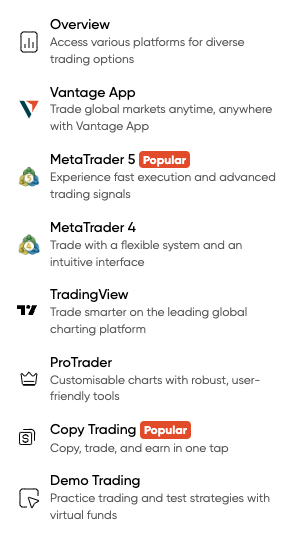

What platforms does Vantage Markets offer?

Vantage provides a versatile selection of trading platforms designed to suit a wide range of trading styles and experience levels:

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5) – Industry-standard platforms for forex and CFD trading.

- ProTrader – A proprietary solution offering advanced charting, one-click trading, and integrated analytics.

- TradingView Integration – Seamless access to TradingView’s popular social charting features.

- Vantage Mobile App – A user-friendly platform for traders who prefer mobility without sacrificing functionality.

All platforms support algorithmic trading, social trading, and a variety of analytical tools, providing flexibility for both discretionary and systematic traders.

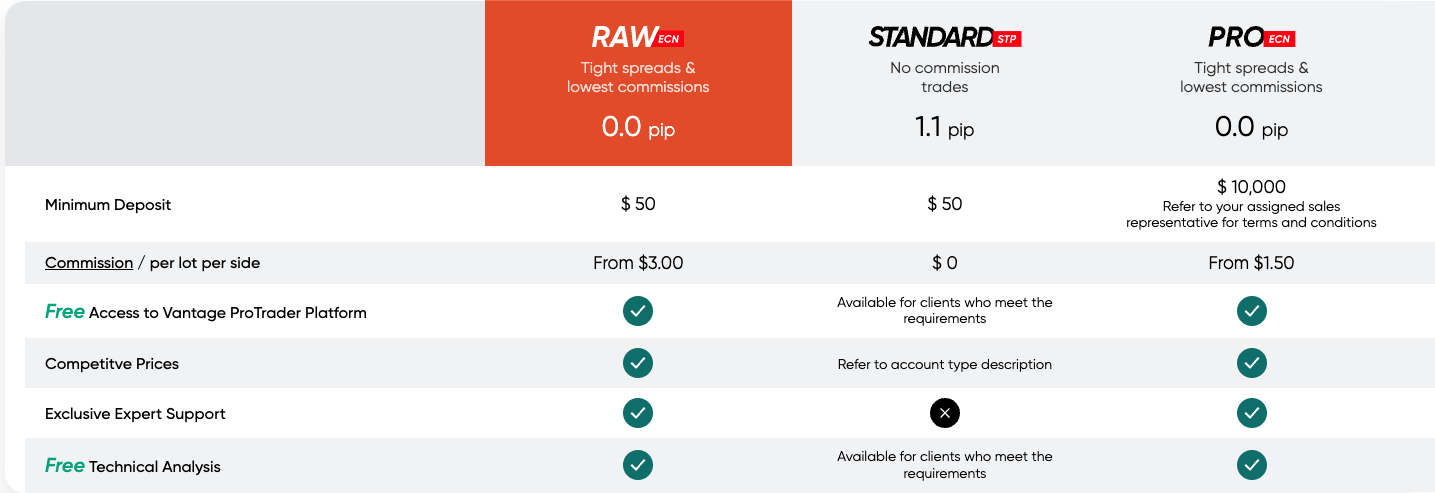

What are the Vantage Markets account types?

Vantage Markets recognizes that every trader has different goals, which is why they offer a diverse set of account types:

1- Raw ECN Account

(Electronic Communication Network — Best for Scalpers and High-Frequency Traders)

The Raw ECN account gives traders direct market access with ultra-tight spreads starting from 0.0 pips. This type of account is perfect for traders who focus on short-term strategies like scalping or automated trading, where every pip counts. Vantage charges a fixed commission per trade, making pricing transparent and predictable.

Key Features:

- Spreads: Starting from 0.0 pips.

- Commission: $3 per lot per side.

- Execution: Lightning-fast order execution on deep liquidity pools.

- Minimum deposit: $50.

- Leverage: Up to 500:1 depending on the regulatory jurisdiction.

Ideal for experienced traders who prioritize tight spreads and fast execution over a commission-free model.

2- Standard STP Account

(Straight Through Processing – Best for Beginners)

The Standard STP Account is designed for new traders or those who prefer a simple, commission-free fee model. This account offers direct access to the market with no dealing desk intervention. Vantage makes money through the spread — which starts from 1.0 pip — rather than charging separate commissions.

Key Features:

- No commissions — only spreads apply.

- Access to all trading instruments including forex, commodities, indices, and shares.

- Leverage: Up to 500:1 (depending on regulation).

- Minimum deposit: Typically $50 — ideal for entry-level traders.

This account suits traders who want straightforward cost structures without worrying about commission calculations.

3- Pro ECN Account

(Tailored for Professional & High-Net-Worth Traders)

The Pro ECN Account is built for institutional-level or high-volume traders who need premium execution conditions and prefer lower commission costs on large trades. While it requires a higher minimum deposit, the Pro ECN offers the most competitive trading costs within Vantage’s offerings.

Key Features:

- Spreads: Starting from 0.0 pips.

- Commission: Lower than Raw ECN (custom-negotiated, often $2 per lot per side).

- Priority execution — designed for professional and algorithmic strategies.

- Minimum deposit: $10,000 (varies by region).

- Leverage: Up to 500:1 (depending on regulation).

This account is best suited for hedge fund managers, prop traders, and seasoned individuals managing significant trading capital.

4- Swap-Free Account

(Islamic Account — Sharia-Compliant)

Vantage offers a Swap-Free Account specifically for traders who wish to adhere to Islamic finance principles. Unlike conventional accounts that either credit or debit overnight swap fees for holding positions, this account structure completely removes interest-based swaps and replaces them with a transparent, flat administration fee when applicable.

Key Features:

- No interest (swap) fees — compliant with Islamic finance principles.

- Same market access and spreads as Standard or Raw ECN, depending on the chosen structure.

- Commission structure: Reflects either the Standard or Raw ECN model.

- Available upon request and subject to approval.

An excellent option for traders following Sharia law or anyone seeking swap-free trading.

5- Demo Account

(Practice Trading Risk-Free)

The Demo Account allows traders to simulate real market conditions without the risk of financial loss. Perfect for beginners learning the ropes or experienced traders testing new strategies, the Demo Account mirrors the pricing and execution of live accounts but uses virtual funds.

Key Features:

- $100,000 in virtual balance (default, customizable).

- Access to all platforms: MT4, MT5, ProTrader, TradingView.

- No time limits (some brokers limit demo life, Vantage allows extensions).

- Risk-free environment to build trading confidence.

Highly recommended for anyone starting in forex or testing new systems, strategies, or EAs (Expert Advisors).

What is the Vantage minimum deposit?

The minimum deposit may vary depending on your country of residence, payment method, or regulatory region, but in most cases, the $50 entry-level threshold applies to new traders opening either the Standard or Raw ECN accounts.

The minimum deposit at Vantage Markets depends on the type of trading account you open:

Standard STP Account

- Minimum deposit: $50

- Designed for beginner to intermediate traders

- Commission-free, with spreads starting from 1.0 pip

Raw ECN Account

- Minimum deposit: $50

- Tight spreads from 0.0 pips

- Commission of $3 per lot per side

Pro ECN Account

- Minimum deposit: $10,000

- Tailored for professional or institutional traders

- Lower commission costs with priority execution

| Account Type | Best For | Commission | Spreads | Min. Deposit |

|---|---|---|---|---|

| Standard STP | Beginners & casual traders | None | From 1.0 pip | $50 |

| Raw ECN | Scalpers & algorithmic traders | $3/lot side | From 0.0 pip | $50 |

| Pro ECN | Professional and institutional traders | Lower (custom) | From 0.0 pip | $10,000 |

| Swap-Free Islamic | Sharia-compliant trading | Varies | Matches STP/ECN | $50+ |

| Demo Account | Learning & strategy testing | None | Simulated | Free |

Spreads & Commissions

Vantage maintains competitive pricing across its account offerings:

- Standard Account: Spreads start from 1.0 pip with zero commission.

- Raw ECN Account: Ultra-tight spreads from 0.0 pips, with a transparent commission of $3 per lot per side.

This fee structure is designed to provide both flexibility and cost-effectiveness, making it suitable for day traders, scalpers, and long-term investors alike.

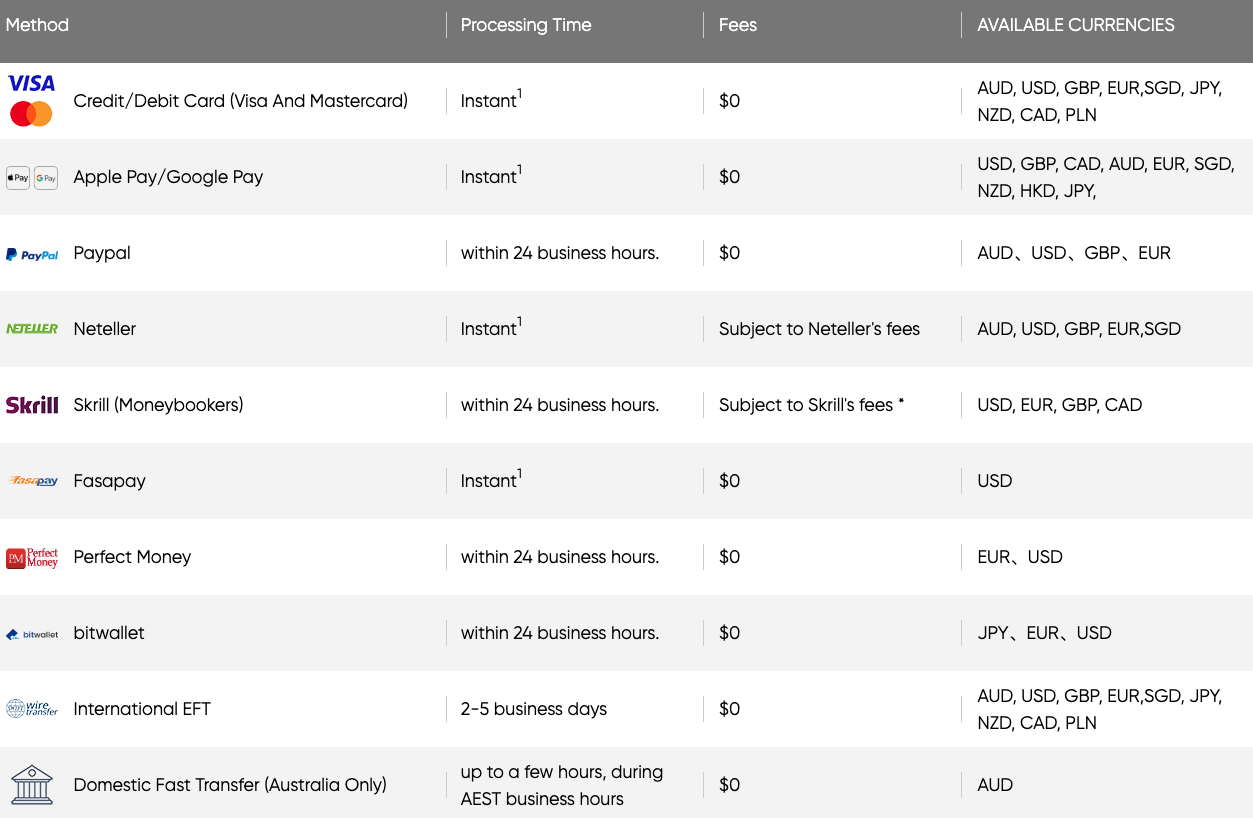

Vantage Markets deposit and withdrawal methods

Vantage Markets understands that seamless fund management is a critical aspect of every trader’s journey, which is why the broker offers a wide variety of secure and flexible deposit and withdrawal methods tailored to meet global client needs.

Deposit Methods

Vantage provides multiple channels for funding your trading account, each designed for speed, security, and ease of access:

| Method | Processing Time | Fees |

|---|---|---|

| Bank Wire Transfer | 1 – 3 Business Days | Usually Free* |

| Credit/Debit Cards | Instant (Visa, Mastercard) | Usually Free |

| E-Wallets | Instant (Neteller, Skrill) | Usually Free |

| Cryptocurrencies | Instant to a Few Hours | Blockchain Network Fees Apply |

*Note: Vantage does not typically charge deposit fees, but your bank or payment provider might.

- Bank Transfer — A globally trusted method ideal for large transfers, but slower than digital options.

- Credit/Debit Cards — The most convenient choice for instant funding, especially for retail traders.

- E-Wallets — Preferred by users seeking fast, borderless transactions with minimal banking delays.

- Cryptocurrencies — A modern solution for digital-native traders, offering global accessibility and decentralized transfers.

Withdrawal Methods

Withdrawing funds from your Vantage account is designed to be straightforward and secure. Here’s what to expect:

| Method | Processing Time | Fees |

|---|---|---|

| Bank Wire Transfer | 1 – 3 Business Days | Depends on Bank |

| Credit/Debit Cards | 2 – 5 Business Days | Usually Free |

| E-Wallets | Within 24 Hours | Usually Free |

| Cryptocurrencies | Within 24 Hours | Blockchain Fees Apply |

Important:

- Withdrawals are processed to the original deposit source, as part of Vantage’s strict anti-money laundering (AML) policy.

- If you deposit via multiple methods, the withdrawal must be made proportionally.

- Identity verification (KYC) is required before any withdrawal is processed, ensuring security for both parties.

Leverage & Margin Requirements

Vantage’s leverage offering varies depending on regulatory jurisdiction:

- ASIC and FCA clients: Maximum leverage of 30:1, aligned with retail investor protection standards.

- VFSC and CIMA clients: Leverage options extend up to 500:1, allowing for more aggressive strategies but also higher risk.

High leverage amplifies both potential gains and losses — responsible use of leverage is strongly advised.

Customer Support

Vantage offers reliable customer service through multiple channels:

- Live Chat

- Email Support

- Phone Assistance

Available 24 hours a day, Monday through Friday, the support team is known for prompt and professional responses, whether the inquiry is technical, account-related, or educational.

What Makes Vantage Stand Out?

- Speed: E-wallets and cryptocurrencies offer almost immediate withdrawals.

- Flexibility: Multiple methods ensure both traditional and modern traders are covered.

- Security: Every transaction is encrypted and adheres to international AML and KYC standards.

- Transparency: Fees are clearly stated, and Vantage strives to avoid hidden costs.

This wide selection of deposit and withdrawal methods gives both beginners and seasoned traders full confidence that their funds are accessible and well-protected, aligning perfectly with Vantage’s commitment to reliability and customer satisfaction.

Are there bonuses or promotional offers on Vantage Markets?

Vantage occasionally rolls out attractive promotions:

- Welcome and Deposit Bonuses

- Referral Rewards Programs

- Seasonal Trading Contests

These incentives come with detailed terms and conditions, so traders are encouraged to review the fine print to ensure full understanding before participation.

What assets can you trade on Vantage Markets?

Vantage Markets offers a broad and diverse range of trading instruments designed to meet the needs of retail and professional traders alike. Here’s what clients can access:

| Asset Class | Available Instruments |

|---|---|

| Forex (FX) | 40+ Major, Minor, and Exotic Currency Pairs |

| Commodities | Precious Metals (Gold, Silver), Energy (WTI, Brent, Natural Gas) |

| Indices | Global Stock Indices (US30, SP500, NAS100, FTSE100, DAX, Nikkei 225) |

| Shares/Stocks | 100+ Global Stocks via CFDs (Apple, Tesla, Amazon, Meta, and more) |

| Cryptocurrencies | Major Crypto CFDs: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and others |

| ETFs | Select Exchange-Traded Funds via CFD |

| Bonds | Limited government and corporate bond CFDs (varies by region) |

Is Vantage Markets good for scalping?

Yes, Vantage Markets fully allows scalping.

Vantage is known for its scalper-friendly trading conditions, especially on its Raw ECN and Pro ECN accounts. These accounts offer ultra-tight spreads starting from 0.0 pips and lightning-fast execution, which are essential for scalping strategies.

Scalping, which involves opening and closing multiple short-term trades to capture small price movements, is unrestricted on Vantage platforms, including MetaTrader 4, MetaTrader 5, and ProTrader.

This makes Vantage a strong choice for high-frequency traders and algorithmic trading setups.

In Which Countries is Vantage Markets not Available?

Vantage Markets is a global broker but due to regulatory compliance, it has some country restrictions.

| 🌍 Available In | ❌ Not Available In |

|---|---|

| Europe (except UK residents under FCA)* | United States |

| Asia-Pacific: Australia, Singapore, Indonesia, Thailand, Vietnam, Malaysia, Philippines | Canada |

| Africa: South Africa, Nigeria, Kenya | North Korea |

| Middle East: UAE, Qatar, Saudi Arabia | Iran |

| Latin America: Brazil, Mexico, Chile | Cuba, Syria, Sudan, Crimea region |

*Note:

In the UK, due to Brexit and FCA rules, clients are now usually onboarded under offshore entities like VFSC or CIMA, not FCA.

Vantage complies strictly with international financial regulations, and residents from sanctioned or high-risk countries are not accepted.

Final Thoughts:

Vantage Markets combines regulatory trust, competitive trading conditions, and technological flexibility — making it an excellent choice for traders seeking both reliability and performance. While the broker could refine its educational offerings, its transparent fee structure and multi-platform access make it a solid contender in the global forex landscape.