1:2000 Leverage

Equiti establishes an international offering to trade a range of instruments through market execution, transparent pricing model and multiple customer support. The broker mainstays at the market-leading MT5 platform, which is a plus to all kinds of traders, from beginners to veterans. Also, with its focus on MENA region, there are some good opportunities with swap-free accounts and tailored solutions.

Equiti

Equiti started out as the Divasa Group in 2008, before rebranding its affiliates in the UK, US, and Jordan, to the Equiti Group in 2018. The broker currently operates in regions as diverse as Europe, the Americas, Africa and the Middle East. It has flourished and can now report 300 staff members around the world.

Is Equiti Regulated? Legit? Safe?

The Equiti Group is licensed by key regulators in its major regions. Besides being licensed and regulated by the highly regarded FCA in the UK, it is well-regulated in the MENA region. It is licensed by the JSC in Jordan, and its Dubai affiliate is regulated by the DMCC and the SCA.

We view this as a positive, because complying with regulation is no easy feat, and the broker has done the work required to get there. However, apart from these key regulators, the broker operates in areas like Kenya, the Seychelles, and Armenia that are regulated by second-tier financial oversight bodies.

Overall, for a broker of its size, Equiti.com can be considered reasonably safe, albeit with the caveats we have mentioned.

How does Equiti protect clients’ money?

Besides the client fund protections offered by the FSCS, as mandated by the FCA, the broker has taken out additional investor fund insurance up to $1,000,000 per client. Clients pay nothing to access the facility, but one big drawback is that only traders with accounts over $25,000 can get the benefit of this protection.

What platforms does Equiti offer?

The broker offers simple tools in the area of platform accessibility. Traders can make use of the downloadable trading platform MT5, or the Web-based Equiti EQ Trader, which is the company’s proprietary platform.

MT5

This household name in the trading world provides users with an intuitive environment for newcomers and seasoned traders alike. Clients get access to:

- Extensive trading histories.

- 30 advanced charting tools.

- 50 technical indicators.

- Nine timeframes.

- Automated trading capabilities through Expert Advisors (EA).

- Built-in research and analysis tools.

Equiti EQ Trader

This Web-enabled platform allows traders to work in FOREX, commodities, stocks, indices and precious metals. It offers its own powerful slate of functions:

- Six charting types.

- Nine timeframes.

- 25 analysis tools.

- 48 indicators.

- Built-in risk management tools.

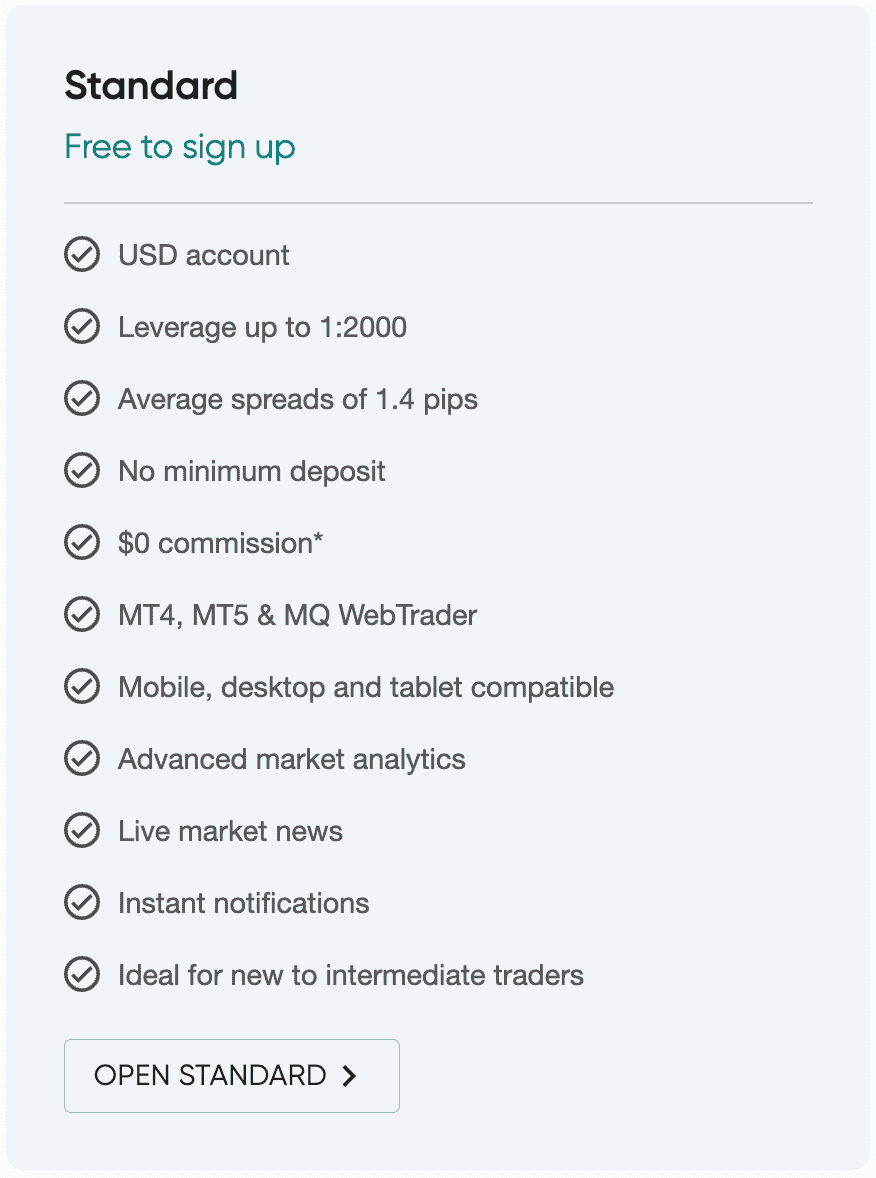

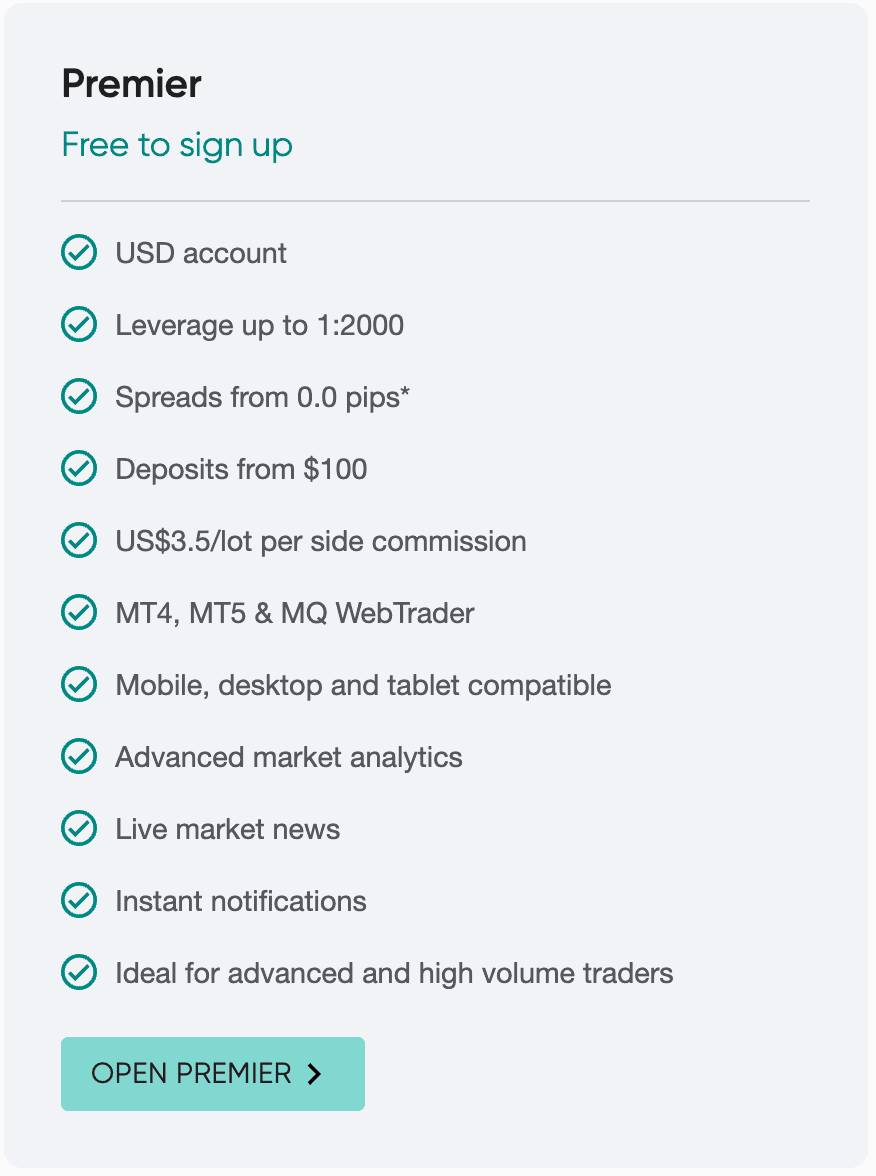

What are the Equiti account types?

Equiti offers two account types with the following features:

What are the fees and commissions on Equiti?

Equiti.com offers spreads on its Premiere Account that are competitive at 0.2 pips for major currency pairs. The Executive Account spreads are less competitive at typically 1.6 pips for the same currency pairs.

The Premiere Account attracts commission rates of $70 per $1 million for selected FOREX pairs, and $7 per standard lot on precious metals. Other instruments are commission-free. There are rollover fees on positions kept beyond a certain time of day.

Swaps are variable, and they change with the instrument and market. Accounts that are inactive for 180 days are charged a monthly fee. We found this to be a generously long waiting window, as some brokers will charge traders an inactivity fee much sooner.

What is the Equiti minimum deposit?

Equiti.com does not charge any fees for deposits, but traders should be aware of the $1 minimum for first time depositors. Accounts can be funded by:

- Bank wire transfer

- Debit and credit cards

- Neteller

- Skrill

- Crypto wallets (USDT, BTC, ETH and many more)

What are the Equiti deposit and withdrawal methods?

Processing times and key information for each method is as follows:

Bank wire transfer:

- Three to five working days processing

- Minimum withdrawal $50

- Withdrawal fee $30

Debit/Credit cards:

- Five to 14 working days processing

- Minimum withdrawal $30

- Withdrawal fee is zero

Neteller/Skrill:

- One working day processing

- Minimum withdrawal $30

- $30 maximum fee per transaction based on 1% of withdrawn amount

Crypto Wallets:

- USDT

- BTC

- Ethereum and many more

Are there bonuses or promotional offers on Equiti?

At the time of writing, this broker did not offer any bonuses, rewards or promotions.

What assets can you trade on Equiti?

As aforementioned, the company offers over 300 financial products, including 62 currency pairs, six precious metals, 37 CFD instruments and over 150 shares from major markets such as the UK, EU and the US. The broker does not offer trading in cryptocurrencies at present.

Is Equiti good for scalping?

Yes, Equiti welcomes any trading strategies that are in line with SCA’s regulations and our internal terms & conditions.

In Which Countries is Equiti not Available?

Afghanistan, Bahamas, Belarus, Belgium, Burundi, Congo (Brazzaville), Congo The Democratic Republic, Crimea, Cuba, Eritrea, Haiti, Iran, Myanmar, Nicaragua, North Korea, Russia, Somalia, South Sudan, Sudan, Syria, Turkmenistan, United Kingdom, United States, United States Virgin Islands, United States Minor Outlying Islands, Yemen, Western Sahara, Zimbabwe

Final Thoughts:

This broker does not provide a high-end offering. It offers a simple, accessible and easy-to-understand product that is equally suitable to beginner and advanced traders. Equiti.com tries to keep its products simple and do them well.

Users can try one of two trading accounts that are based on ECN trading. The fees are competitive, and traders will get access to tight spreads on certain accounts and no commissions where applicable. They can trade over 300 financial CFD instruments covering FOREX, indices, metals, energies and stocks from major markets.

Clients can choose between the dependable MT5 for desktop and mobile or Equiti’s own proprietary EQ Trader platform that is Web-enabled and requires no download.

Brokers who need a helping hand can access an extensive range of research and education tools that are tailored to look after traders of all levels. The material is well-produced and is laid out in an easy-to-follow fashion. If they need help, traders can access quality support through multiple channels on a 24/6 basis.

Low - Fix&Var

Low - Fix&Var