1:3000 Leverage

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75,3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Exness

Exness is a leading tech-driven multi-asset broker with exceptional order and volume statistics. It also ranks highly in the client withdrawal category, with $1.6+ billion in quarterly withdrawals. Traders get to enjoy the MT4/MT5 trading platforms plus two proprietary alternatives, ultra-low trading fees, and flexible leverage. I conducted a comprehensive Exness review to evaluate if the Exness trading environment offers traders a competitive edge.

Is Exness Regulated? Legit? Safe?

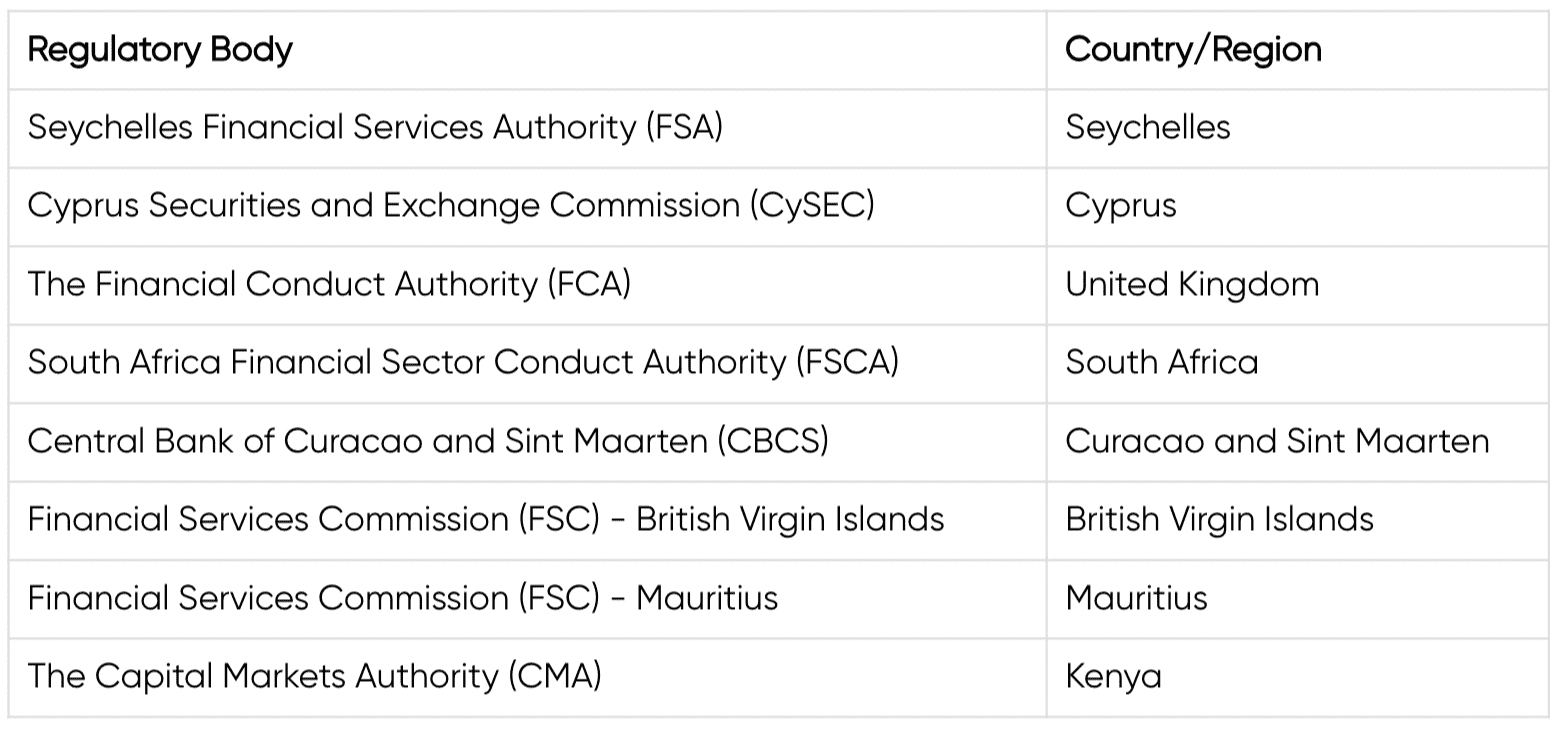

Exness is authorised by two tier-1 regulators (highly trusted), three tier-2 regulator (trusted), zero tier-3 regulators (average risk), and three tier-4 regulator (High Risk). Exness is authorised by the following tier-1 regulators: Financial Conduct Authority (FCA) and regulated in the European Union via the MiFID passporting system. Other regulators are CMA, CySEC, FCA, FSA, FSC Belize, FSC Mauritius and FSCA.

What platforms does Exness offer?

Exness deploys its lightweight, user-friendly, and web-based proprietary Exness Terminal, complemented by the mobile trading alternative Exness Trade App for Android and iOS devices. The former features 50 drawing tools and 100 indicators, while the latter has 24/7 in-app support, but both are only available for MT5 accounts and only support manual trading strategies.

Traders can also rely on the market-leading MT4, the primary choice for algorithmic trading, and MT5. Both trading platforms feature built-in copy trading services, and the MT4 trading infrastructure remains the most versatile, with 25,000+ add-ons, custom indicators, and EAs.

Exness Account Types

Exness offers five account types which we introduce with a quick overview.

All Exness account types offer a potentially unlimited maximum leverage (subject to local regulation), negative balance protection, margin calls between 30% and 60%, 80 account base currencies, and fast deposit and withdrawal times with a choice of payment processors.

Key Points:

- Minimum deposits between $10 and $200

- Demo accounts available in MT4, MT5, and the web-based platform, fully customizable and without expiration

- Ultra-competitive trading fees, including swap-free trading for all clients.

- Well-balanced asset selection

- Deep liquidity and market-leading order execution statistics

Standard Account

The Exness Standard account requires no minimum deposit, making the minimum dependent on the payment processor. It has a commission-free cost structure, but average minimum spreads are 1.0 pips, or $10.00 per 1.0 standard round lot.

Standard Cent Account

The Exness Standard Cent account only offers Forex and metals trading on MT4 with similar Exness trading fees as the Standard option. It features nano-lot transactions, making it an ideal choice for beginners to learn how to trade in live trading conditions.

Raw Spread Account

The commission based Exness Raw Spread account with a minimum deposit requirement of $200 features spreads from 0.0 pips for a commission of $7.00 per round lot.

Zero Account

The commission based Exness Zero account is the most competitive choice for index and cryptocurrency traders. Trading conditions are identical to the Raw Spread account, except for lower trading fees.

Pro Account

The commission-free Exness Pro account is identical to the Raw Spread option but with notably lower, commission-free trading fees. It is the best choice for Forex, commodity, and equity traders.

Islamic Account

All traders from Islamic countries automatically get the swap-free Exness Islamic account, but Exness offers swap-free trading on many liquid assets for everyone.

Commissions and fees

Exness offers an extensive selection of account types with five primary offerings: two standard accounts and three professional accounts. Note that there are also two specific social copy trading account types, Social Standard and Social Pro, with their own trading conditions for those who wish to share their trading strategies for easy copying.

The trading costs will depend on the account type you select, as the two commission-based accounts have lower spreads compared to the commission-free accounts. All account types use market execution, except for the Pro account which offers both instant and market execution methods.