1:500 Leverage

Fusion Markets offers the advantage of no minimum deposit, which might attract new traders cautious about initial investments. For day trading, particularly in forex and CFDs, is great as it offers a decent selection of currency pairs and CFDs, alongside accounts tailored for different trading needs. Scalping is another area where Fusion Markets is good, thanks to its fast execution speeds and competitive spreads and commissions.

Fusion Markets

Fusion Markets is an online brokerage company founded in Melbourne (Australia) in 2017. FMGP Trading Group Pty Ltd is the parent company of Fusion Markets.

Fusion Markets specializes in providing derivatives trading services on CFDs (Contracts for Difference) across a variety of markets, including Forex, commodities, indices, stocks, ETFs, bonds, and cryptocurrencies.

Is Fusion Markets Regulated? Legit? Safe?

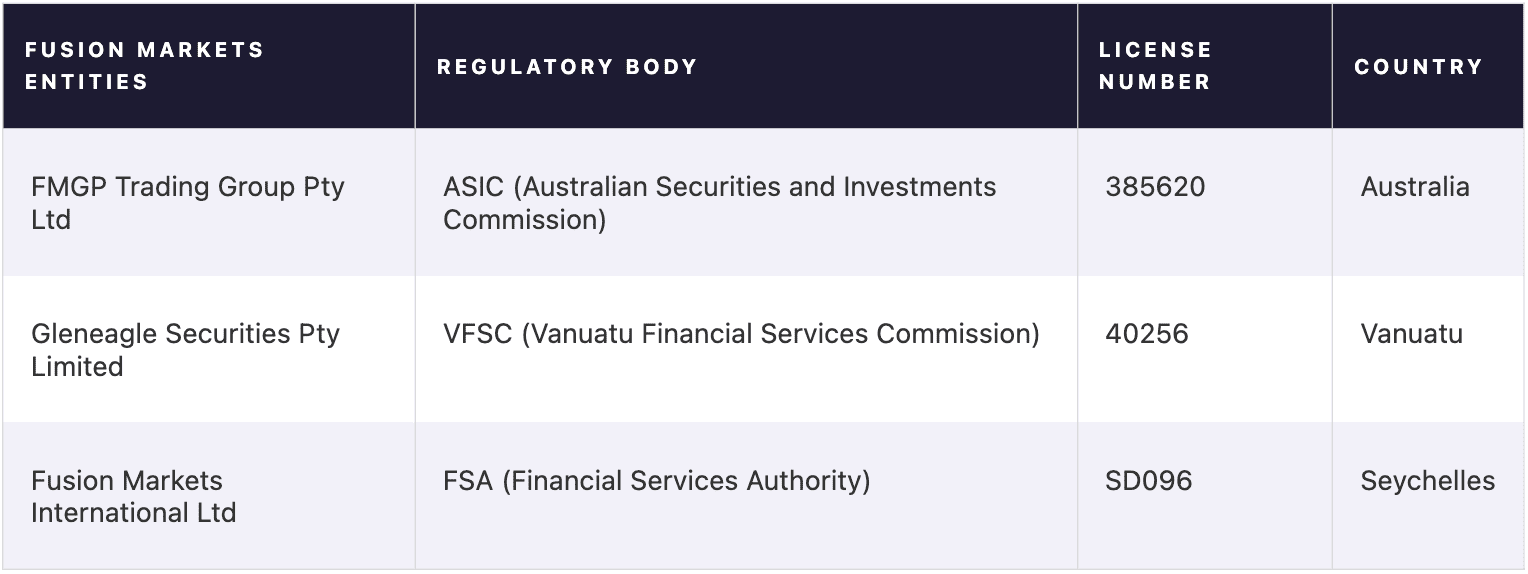

Yes, Fusion Markets is regulated by the VFSC in Vanuatu (40256) and the ASIC in Australia (385620). Since Fusion Markets isn’t licensed by any European bodies, it isn’t ESMA compliant meaning it cannot accept European customers.

The different regulatory bodies Fusion Markets worldwide entities are subjeted to, can be found below:

Fusion Markets is a legit brokerage firm in the trading industry and it’s not a scam. It is a trusted company established in 2017.

Fusion Markets’ headquarter is located in Level 10, 627 Chapel St, South Yarra VIC 3141, Melbourne, Australia.

Fusion Markets is considered safe for traders even though this is not guaranteed for future positive results. It follows strict financial protocols to guarantee the safety of deposits, withdrawals and other financial transactions.

Additionally, Fusion Markets segregates its bank accounts to keep client funds separate from company assets, and provide their clients with MetaTrader platforms, renowned for their reliability and robustness in the trading industry.

How does Fusion Markets protect clients’ money?

Fusion markets secures client’s money by storing them in segregated accounts at top-level banks such as the HSBC bank in the UK and the National Australia Bank (NAB) in Australia. This segregation ensures that client funds remain secure, irrespective of any future issues that may arise with the broker.

What platforms does Fusion Markets offer?

The trading platforms provided by Fusion Markets are listed below:

- MetaTrader 4 (MT4), available as webtrader, desktop and mobile

- MetaTrader 5 (MT5), available as webtrader, desktop and mobile

- cTrader, available as webtrader, desktop and mobile

- MetaFX platform for MAM/PAMM accounts

- Fusion+ trading platform for copy trading

- Duplitrade platform

- MyFxBook platform

What are the Fusion Markets account types?

Fusion Markets provides a variety of account types to suit the needs of any trader. The Fusion Markets account types are presented in this table below:

For whom are account types suitable?

- Fusion Markets classic account: Best for casual traders

- Fusion Markets ero account: Best for scalpers

- Fusion Markets MAM account: Best for professional trader that manages money for other clients

- Fusion Markets Islamic account: best for Muslim traders

What are the fees on Fusion Markets?

The fees and commissions charged by Fusion Markets are listed below:

- Spreads: Spread on Fusion Markets starts from 0 pips on the Zero Account (0,03 on average on the EUR/USD forex pair). The Classic account charge higher spreads up to 0.9 pips with the standard account.

- Volume-based commissions: $4,50 commission per each forex lot traded when using a Fusion Markets Zero Account.

- Overnight fees: All trades kept overnight on Fusion Markets charge overnight fees.

- Conversion fee: Every transaction that involves a currency different than the account base currency, will be charged a conversion fee.

Fusion Markets trading spreads and commissions

The average cost per trade at Fusion Markets is $6.75, determined as an overall average across all account types (32.50% lower than the industry standard for average trade costs). This calculation is based on a 1-lot volume trade involving the EUR/USD Forex pair.

When it comes to the individual account types at Fusion Markets, there’s the Classic account that charges spread mark-ups without additional commissions. Here spreads start from 0,9 pips, which make this account type 10% cheaper than the industry standard of 1 pip.

On the other hand, there’s also a raw spread account called “Zero Account” which offers spreads from 0.03 pips on average. Since there’s no mark-up, Fusion Markets charges a commission of $4.50/lot round turn. This commission is 35% lower than the industry average, considering that most trading accounts of this kind charge a commission of $7/lot.

What is the Fusion Markets minimum deposit?

Fusion Markets doesn’t require a minimum deposit to open both Zero and Classic accounts.

In order to fund the Fusion Markets account, you can use payment methods such as bank wires, credit/debit cards, and ewallets. Your funds will be ready on the Fusion Markets account in about 2-3 business days on average.

What are the Fusion Markets deposit and withdrawal methods?

Fusion Markets enables deposits and withdrawals through several methods including wire transfer, credit/debit cards (Visa and Mastercard), eWallets (Neteller and Skrill), and local bank transfers.

Keep in mind though, that some of these payment methods may be available only in specific countries or world regions. Additionally, the Fusion Markets withdrawal method must be the same used for depositing funds.

Also, depending on the method there is a minimum withdrawable amount of $30.

Fusion Markets do not charge any withdrawal fees, but if you need for an international bank wire, there might be a fee involved.

Are there bonuses or promotional offers on Fusion Markets?

Fusion Markets doesn’t offer bonuses nor promotional offers.

What assets can you trade on Fusion Markets?

On Fusion Markets you can trade over 500 CFDs (Contract For Difference) assets in different markets such as Forex, metals, energies, indices, stocks, commodities, bonds, ETFs and cryptos.

Some assets are unavailable for trading, depending on the Fusion Markets entity. Such is the case of cryptocurrencies for retail traders residing in the EU, UK and Australia.

Is Fusion Markets good for scalping?

Yes, Fusion Markets is a good choice for scalping.

The Fusion Markets Zero account is particularly well-suited for this style of trading, offering fast execution speeds at around 34 milliseconds, which is crucial for the rapid trading style of scalping. The account provides raw spreads, with an average of 0.03 on the EUR/USD pair, plus a low commission of $4.50 per round-turn.

In Which Countries is Fusion Markets not Available?

Fusion Markets is not available in Afghanistan, Congo, Iran, Iraq, Myanmar, New Zealand, North Korea, Palestine, Russia, Somalia, Sudan, Syria, Ukraine, Ontario, Yemen, Japan, or the United States.

Final Thoughts:

The key features and main characteristics of Fusion Markets are listed below:

- Forex and CFD trading: At Fusion Markets you can find over 200 CFD assets, including 80 CFD forex pairs to trade.

- Low trading costs: Fusion Markets offers very low trading costs on their Zero Account, with average spreads from 0.03 pips plus a competitive fee of $4.50/lot round turn.

- Fast order execution: According to Fusion Markets, their average execution speed across all assets is 34ms (as of Aug.2023).

- Algorithmic trading: Fusion Markets caters for algo traders, and they also offer sponsored VPS services to facilitate automated trading activities.

- Wide range of platforms: At Fusion Markets you can trade on MT4, MT5, cTrader, and Duplitrade.