1:2000 Leverage

HFM is considered a good broker for a variety of trading activities. It’s particularly beneficial for beginners due to its educational resources, demo account, and low minimum deposit requirements. HFM excels in Forex, offering a broad range of over 50 Forex pairs with competitive conditions like low spreads and reasonable commissions. It’s also suitable for day trading and scalping, providing favorable spreads and fast execution times.

HFM (HotForex)

HFM (formerly known as HotForex) is an online brokerage firm founded in 2010 in Cyprus, part of the HF Markets Group. HFM offers CFD (Contract For Difference) trading on Forex, commodities, stocks, cryptos and indices. HFM is a globally recognized company dedicated to providing several account types and trading platforms, catering to both novice and experienced traders.

PLEASE NOTE: ‘HF Markets’ is the corporate entity for EU, UK and Australian users. “HFM” on the other hand is the global corporate entity, available in all other countries (except specific countries excluded). This review is based on the HFM global entity offering, which is very similar to the HFM Markets offering (EU, UK, AU). Whenever there is a difference between the offers, it will be promptly stated.

Is HFM Regulated? Legit? Safe?

Yes, HFM is regulated by CySEC (183/12), FCA (801701), DFSA (F004885), FSCA (46632), FSA (SD015), and CMA (155). HFM is ESMA compliant, thanks to the CySEC license and can operate all over the EU thanks to the European passporting system for companies.

HFM is a trusted and global brokerage firm for online Forex and CFD trading established in 2010, and since then it has garnered a trustworthy reputation in the industry, making it a popular choice globally. HFM is part of HF Markets Group, and the headquarters is located in Spyrou Kyprianou 50, Irida 3 Tower, 10th Floor, Larnaca 6057, Cyprus. The HFM presence spans multiple countries, with offices and licenses in Cyprus, the UK, South Africa, the UAE, and St. Vincent and the Grenadines, indicating a significant international footprint.

HFM is considered safe (even though this is not a guarantee of positive future results) as it adheres to strict regulatory and financial standards, ensuring that clients’ money, deposits and withdrawals are secure. The firm protects funds with various safeguards such as segregated bank accounts. It emphasises data security, using encrypted data transmission and storage to protect sensitive information, and employs technologically solid trading platforms like MetaTrader, known for their reliability.

HFM is a supporter and official partner of Paris Saint-Germain F.C., the most successful French football team.

How does HFM protect clients’ money?

HFM (and all the HF Markets Group entities) ensures client funds’ protection through segregated bank accounts, safeguarding them in case of broker insolvency or bankruptcy.

In the EU and UK, this protection is bolstered by the ICF (Investor Compensation Fund) and the FSCS (Financial Services Compensation Scheme), offering insurance compensation of up to €20,000 or £85,000, respectively, in the unlikely event the broker cannot meet financial obligations. This ensures clients’ investments are secure and minimises the risk of losing more than their initial investment.

Additionally, within the European Union, HF Markets provides Negative Balance Protection, which means that traders will never lose more money than they deposit.

What platforms does HFM offer?

The HFM’s trading platforms are listed below:

- MetaTrader 4 (MT4), available as webtrader, desktop and mobile

- MetaTrader 5 (MT5), available as webtrader, desktop and mobile

- HFM platform, available as a mobile app

HFM provides the most common orders for risk management on all trading platforms such as: stop losses, take profit, limit orders, and trailing stops. Each trading platform offers fundamental analysis tools along with basic trading indicators (such as Moving Averages) for technical analysis.

What are the HFM account types?

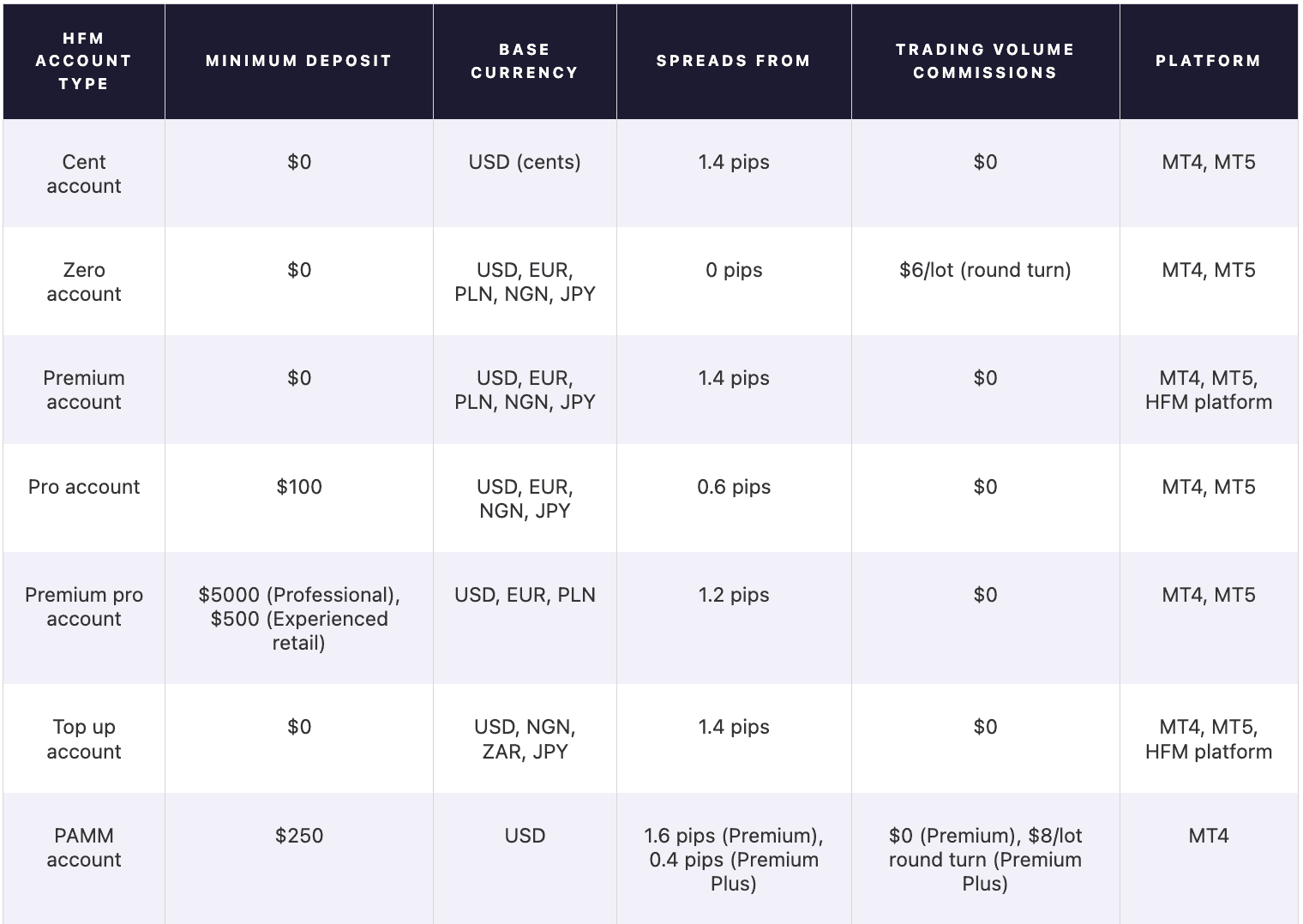

HFM provides a variety of account types to suit the needs of any trader. The HFM account types are all listed below:

For whom are account types suitable?

- HF Markets Micro account: Best for beginners

- HF Markets Premium account: Best for experienced retail traders

- HF Markets Zero spread account: Best for scalpers

- HF Markets Auto account: Best for algo traders

- HF Markets Premium pro account: Best for high-volume traders

- HF Markets Copy account: Best for copy traders

- HF Markets VIP account: Best for exclusive traders

- HF Markets MAM/PAMM account: Best for fund managers

- HF Markets Islamic account: Best for Muslim traders

What are the fees on HFM?

The fees and commissions charged by HFM are listed below:

- Spreads: Spread on HFM starts from 0 pips on the Zero account. Other accounts charge higher spreads up to 1.6 pips with the PAMM account.

- Volume-based commissions: $6/lot commission round turn on forex when using an HFM zero account.

- Overnight fees: HFM does charge an overnight fee unless you have a swap-free account.

- Inactivity fees: HFM charges a monthly $5 fee after 6 months of inactivity.

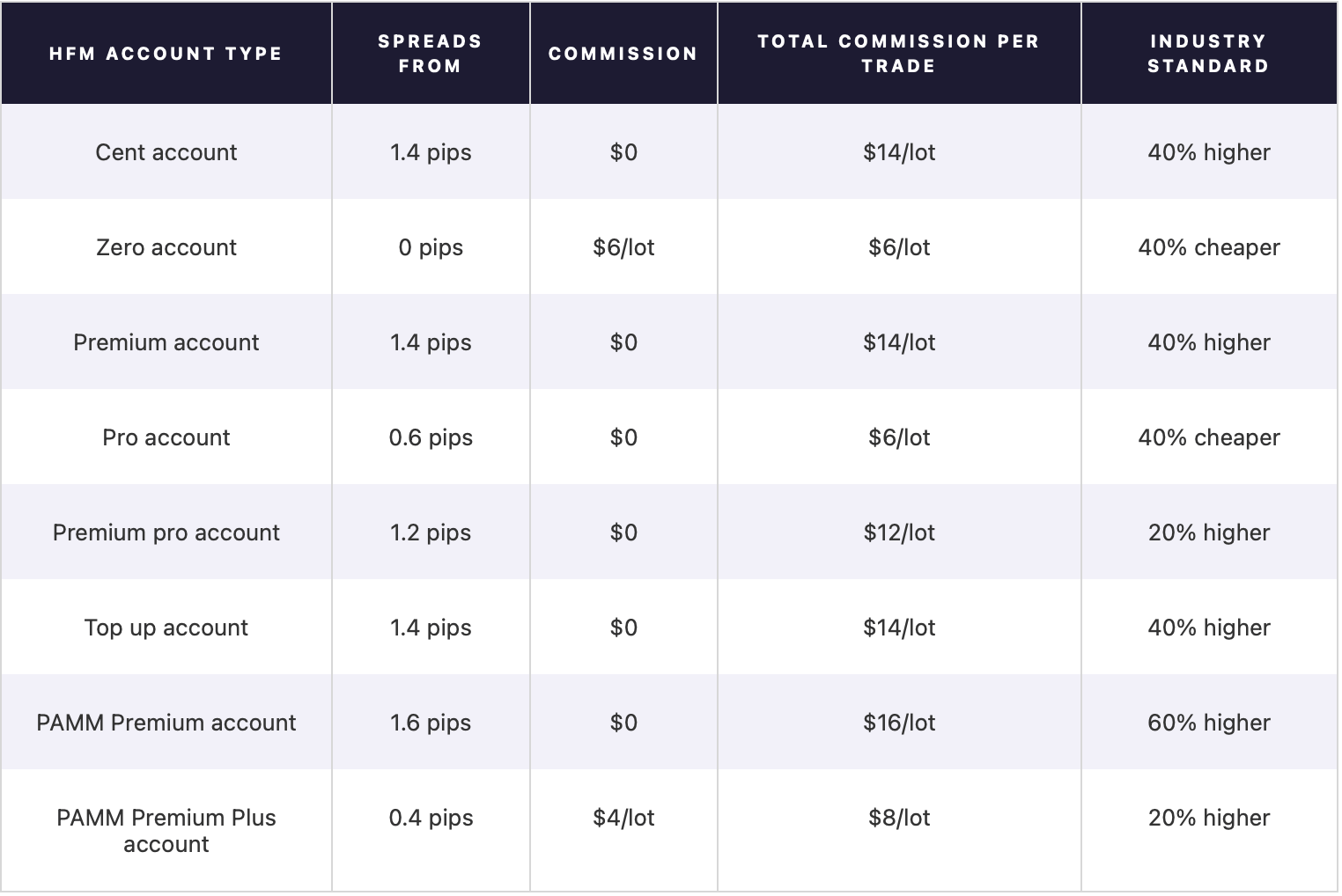

HFM trading spreads and commissions

The HFM average cost per trade is $11,25, calculated as an average across all HFM account types (12,50% higher than the average cost per trade industry standard), considering a 1 lot volume trade on the EUR/USD Forex pair.

The cheapest account on HFM is the HFM Zero account with raw spreads starting from 0 pips and $6/lot commission round turn (14% cheaper than the standard industry commission of $7/lot).

Similar trading conditions can be found with the HFM pro account, where the cost per trade starts from $6, but by charging spreads from 0,6 pips (which are 40% lower than the industry standard of 1 pip).

The HFM standard account, called HFM Premium Account, charges spreads from 1.4 pips. In other words, for every trade it charges $14 which is 40% higher than the industry standard.

The HFM trading costs breakdown based on each account type available can be found in this table below:

What is the HFM minimum deposit?

The HF Markets minimum deposit ranges from $0 to $5000 depending on the account type. Here’s a complete breakdown of the HFM minimum deposit according to the account types:

- $0 for the Cent, Zero, Top Up and Premium accounts

- $100 for the Pro account

- $250 for the PAMM account

- $500 for the Premium Pro account dedicated to Experienced Retail Clients

- $5000 for the Premium Pro account dedicated to Professional Clients

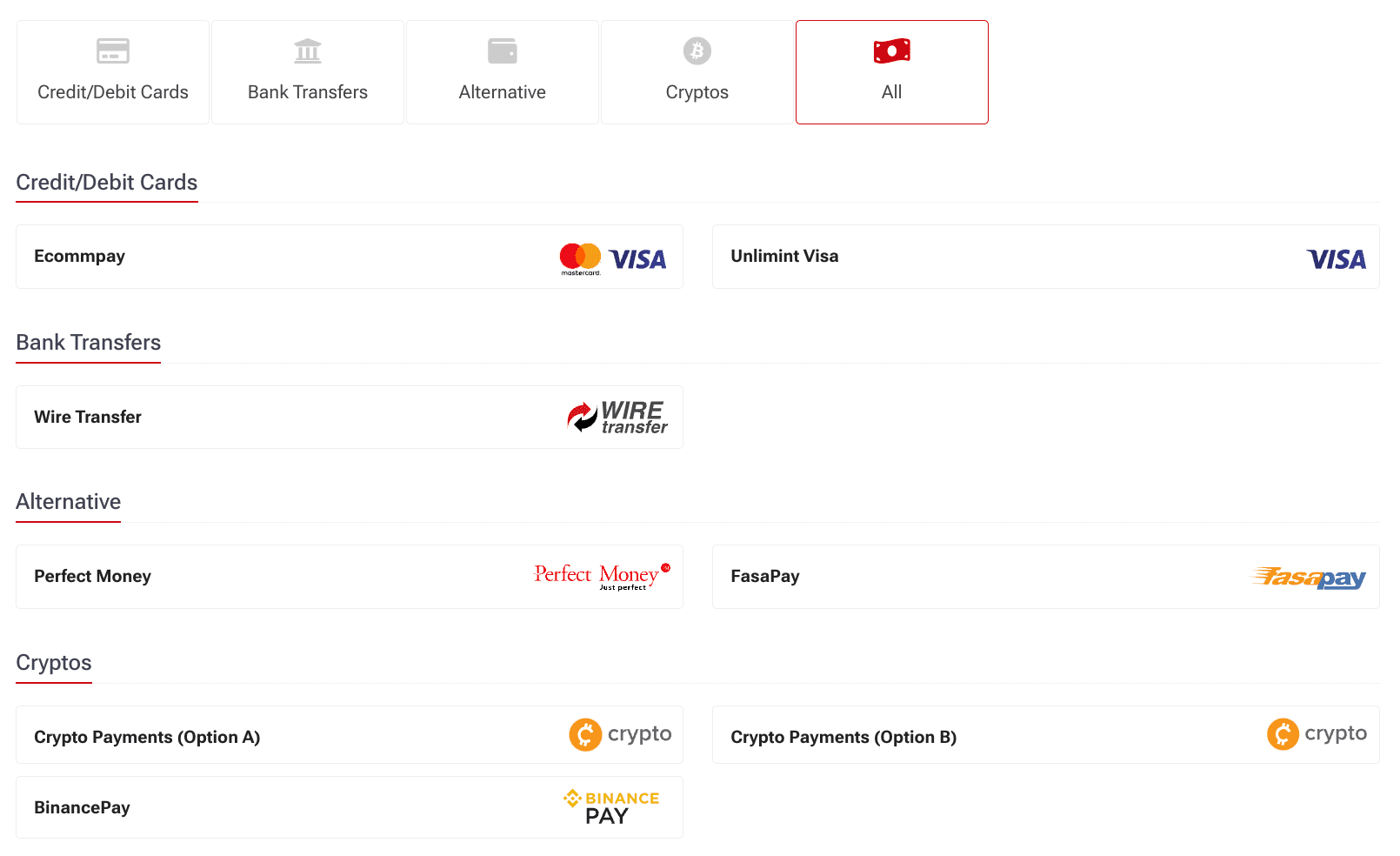

What are the HFM deposit and withdrawal methods?

HFM enables deposits and withdrawals through several methods including wire transfer, credit/debit cards (Visa and Mastercard), ewallets (Neteller and Skrill), and crypto.

The HFM deposit and withdrawal methods are listed below:

Keep in mind though, that some of these payment methods may be not be available in some regions.

Are there bonuses or promotional offers on HFM?

Yes, HFM offers several bonuses and promotional offers to its traders outside the EU, the UK and Australia.

Keep also in mind that bonuses and promotions are usually cyclical, meaning that they may not be available at all times.

The bonuses and promotions offered by HFM to eligible users (as for January 2024) are listed below:

- HFM gadget giveaway: a chance to get a cool gadget available on market

- Traders awards 2024: a monthly contest for a $1,000 prize

- Return on free margin: get daily earning on your wallet to trade

- HFM loyalty program: get prizes in 4 different tiers, the more you trade, the better the prizes

- Virtual to real demo contest: a contest with no monetary risk with a $2000 prize

- HFM merchandise: for the most loyal traders and partners, free of charge

What assets can you trade on HFM?

On HFM you can trade over 500 CFD (Contract For Difference) assets in different markets such as Forex, metals, energies, indices, stocks, commodities, bonds, ETFs and cryptos.

Is HFM good for scalping?

Yes, HFM is suitable for scalping. The HFM Zero account features raw spreads from 0 pips and a trading volume commission of $6/lot round turn. They also offer fast execution times and the option to automate trades with Expert Advisors (EAs).

In Which Countries is HFM not Available?

Belgium, Canada and United States

Final Thoughts:

The key features and main characteristics of HFM are listed below:

- CFD and Forex: HFM is a CFD broker. Here you can trade around 500 CFDs as Forex pairs, commodities, indices, stocks and bonds. Spreads on Forex start from 0 pips depending on account type.

- Raw spreads: HFM offers raw spreads on their Zero Account. This account offers spreads from 0 pips (0.3 pips on average on EUR/USD), and charges a trading volume commission of $6/lot round turn.

- Copy trading: HFM offers a viable copy trading service through their own HF Copy platform. With that said, it should be noted there are way better copy trading and social trading platforms on the market.

- VPS Hosting: HFM offers free VPS services. The base package can be obtained if the trader deposits at least $400.

- Free Autochartist: At HFM you can have autochartist for free once you open a real trading account.

- Premium trader tools: HFM offers a number of premium trading tools such as sentiment indicators, correlation matrix, and much more.

Low - Fix&Var

Low - Fix&Var